Updated April 14, 2023

The 50/30/20 plan is a popular budgeting method that can help you reorganize your budget. It ensures that you’re putting money towards your necessities while still allocating an appropriate amount of cash toward your savings and simple pleasures.

If you’ve tried to create a budget in the past, you may have struggled with prioritizing your expenses. Needs like food, shelter and utilities are likely at the top of your list, but is a new pair of jeans more important than putting money towards your emergency fund? Should medical bills or car payments come before credit card debt? Is it okay to squeeze in a latte if you’re still paying down your college debt? The 50/30/20 budgeting method can help you decide.

Quick Links

- What Does 50/30/20 Stand For?

- How To Use the 50/30/20 Rule

- Identifying Must-Haves, Wants and Savings

- 50/30/20 Budget Examples

Where Does the 50/30/20 Rule Come From?

The 50/30/20 rule was first coined as the “Balanced Money Formula” in the 2005 book, All Your Worth: The Ultimate Lifetime Money Plan. U.S. Senator Elizabeth Warren, who is a bankruptcy and personal finance expert, co-authored the book with her businesswoman and management consultant daughter, Amelia Warren Tyagi.

What Does 50/30/20 Stand For?

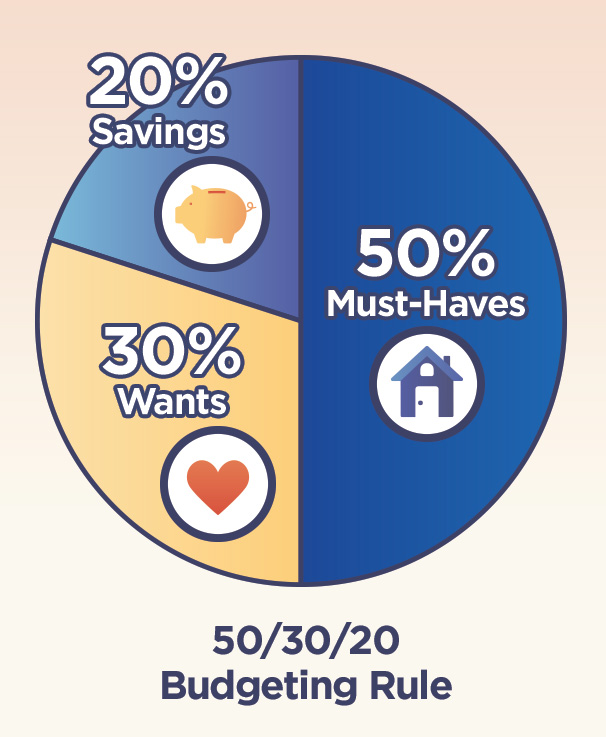

Warren and Tyagi’s Balanced Money Formula breaks down all spending into three categories: Must-Haves, Wants and Savings. The authors suggest that individuals balance their spending and savings as follows:

- Must-Haves: 50%

- Wants: 30%

- Savings: 20%

“Testing yourself against the Balanced Money formula is a little like checking your cholesterol against the recommended levels,” Tyagi and Warren write. “It helps you flag when something is wrong, and it shows you where you need to take a closer look at your money choices.”

How To Use the 50/30/20 Rule

The Balanced Money Formula is simple to remember and put into action. We’ve broken it down into five steps:

- Calculate your take home pay. Include any side work or freelancing income. If your finances are combined with a partner, be sure to include their income as well.

- Build your budget. Where is your money going? Track all of your monthly bills and recurring expenses. For any monthly expenses that vary from month to month, such as groceries and utilities, an average estimate is fine.

- Limit your Must-Haves to 50% of your budget. This category may seem difficult to make cuts in, but many things that we think are Must-Haves aren’t true “musts”. Warren and Tyagi suggest that you ask yourself the following questions to determine if something qualifies as a Must-Have: “Could you live in safety and dignity without this purchase (at least for a while)? If you lost your job, would you keep spending money on this? Could you live without this purchase for six months?”

- Dedicate at least 20% of your take home pay towards Savings and debt repayment. If you’re having trouble with this category, don’t throw in the towel just yet. Tyagi and Warren note that “the money will already be there” once you’re able to get control over your Must-Haves and Wants.

- Allocate the last 30% for the Wants in your budget. While Tyagi and Warren caution those who spend more than 30% in this category, they also warn against underspending. “Life needs to have space just for fun; get into a place where there is room for a little more enjoyment,” they recommend to those spending less than 20% on Wants.

Identifying Must-Haves, Wants and Savings

Must-Haves are “the things you will have to pay no matter what,” like food, rent, utilities, necessary transportation and medical needs. “Can’t-escape legal obligations,” such as child support, long term contracts and student loans, also fit under this category. While it may seem like a larger percentage of your budget could be dedicated to this part of your budget, the authors argue that 50% is ideal because it’s sustainable. They also note many disability insurance and unemployment insurance policies cover roughly 50% of one’s salary. Under this budgeting plan, you’ll still be able to cover the basics if you’re not able to work.

Wants are the “treats and extras,” including vacations, hobbies, charitable donations, non-necessary clothing and entertainment. While this is a fairly broad category, Warren and Tyagi warn that it should have a hard limit of 30%. Additionally, should you find yourself in a situation where you need to make fast cuts, the Wants should be the first things to go.

Savings are both investments in the future and payment towards debt. These include things like your emergency fund, retirement savings, money for a future down payment, credit card debt and medical bills. Warren and Tyagi recommend that you dedicate 20% of your budget to this category.

50/30/20 Budget Examples

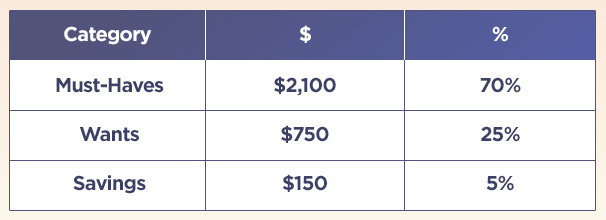

Example A: Melissa

Melissa is a single person who works and lives in a larger city. After taxes and deductions, Melissa takes home about $3,000 a month. Breaking down her current spending habits, her money splits as follows:

Melissa is almost at 30% spending with her Wants, but her Must-Haves and Savings are out of balance. While Must-Haves are the “can’t live without” parts of the budget, that doesn’t mean she can’t reduce her costs. For example, Melissa needs a roof over her head and a way to get to work, but $1,500 rent on a two bedroom apartment and spending an average of $300 a month on gas and car expenses isn’t ideal. She could reduce her Must-Have spending by splitting rent costs with a roommate and swapping her car for public transportation. The money she saves can be redirected towards her budget’s Savings category.

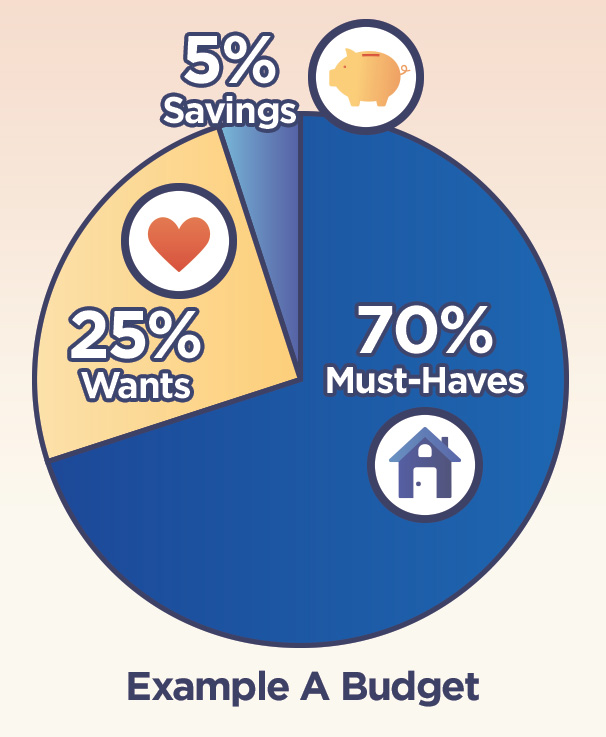

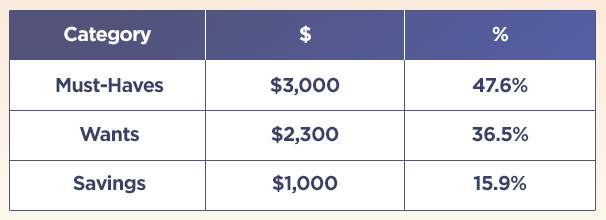

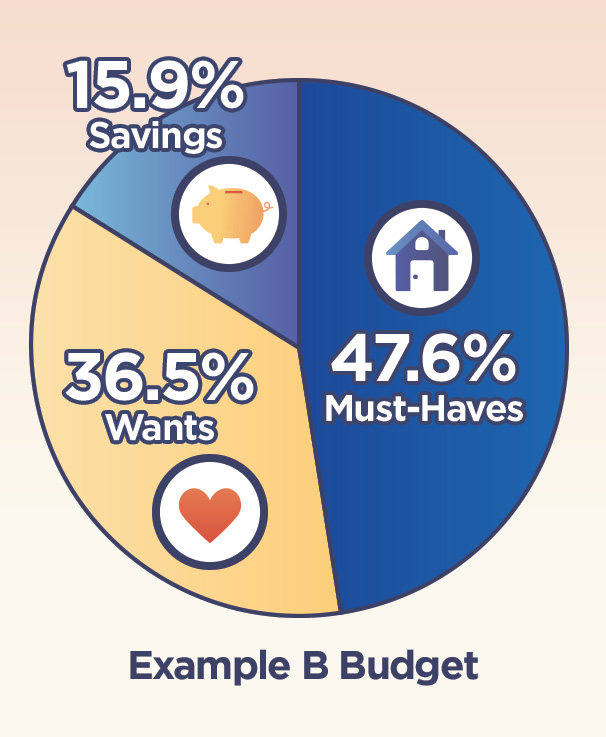

Example B: James and Stacy

James and Stacy are a married suburban couple who are both moving up the corporate ladder. Together, their take home pay is roughly $6,300 a month. After examining their budget, they notice that their spending breaks down as follows:

Stacy and James are closer to 50/30/20 than Melissa, but they can still make improvements. Their Must-Haves are under 50%, which gives them plenty of room for Wants and Savings, but they aren’t hitting the Savings goal of 20%. If they can cut about $300 from their Wants and dedicate it towards Savings, they’ll still have plenty of money to spend on fun things while paying down their debt and saving for their future.

When To Deviate From 50/30/20

While the “Balanced Money Formula” can help individuals prioritize their money, Warren and Tyagi do note specific examples of when it’s okay to stray from or adjust their formula. Here are some examples:

- Whenever you experience a reduction or loss of income, a higher percentage of your budget should go towards Must-Haves.

- If you work seasonally or as an independent contractor, you might put more towards Savings to prepare for times when you have a lower income.

- If you’re retired and have paid off your mortgage, you may be able to redirect more of your Must-Haves money towards Wants.

Start Using the 50/30/20 Budget

Making small adjustments to your spending and saving habits now can greatly improve your financial future. The 50/30/20 formula is a great tool that can be used in combination with other budgeting strategies.

Not sure where to begin with building a budget or saving for emergencies? Check out these helpful articles:

For more information about the 50/30/20 plan, check out All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Warren Tyagi.