The 50/30/20 budgeting rule, made popular in the U.S. by Elizabeth Warren and Amelia Warren Tyagi, has gained mainstream attention since its debut in 2005. However, it’s not the only percentage method for spending your earnings. On the other side of the globe, a similar formula has become incredibly popular: 60/20/20.

How different are these two strategies, and which one is best for your budget? In this blog, we’ll break down 60/20/20, compare it to the “Balanced Money Formula,” and help you decide which one to try first.

Where Does 60/20/20 Budget Come From?

60/20/20 budgeting was made popular by Scott Pape, an Australian author and financial educator who’s better known as “The Barefoot Investor.”

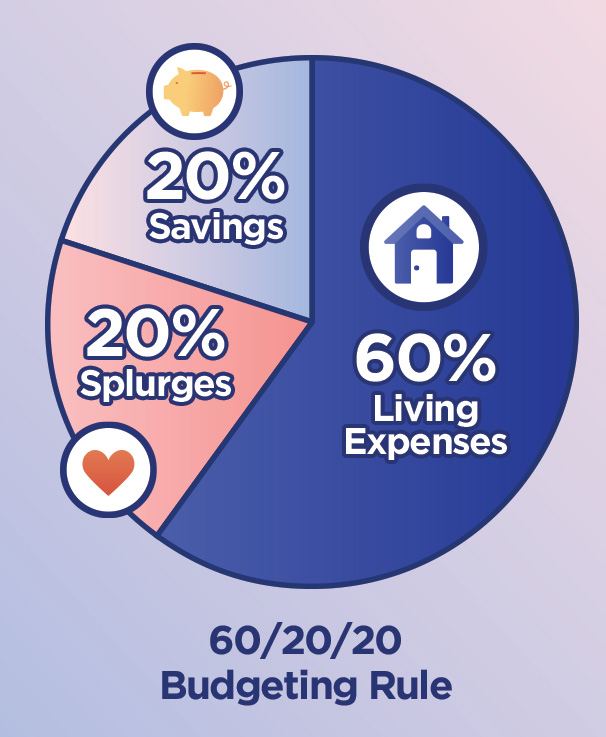

In a 2016 article on budgeting, Pape explains that he’s never followed a strict budget. Instead, he suggests to his readers that they put 60% of their after-tax income towards living costs, 20% towards savings and 20% towards splurges.

The 60/20/20 Budget Breakdown

Living Expenses = 60%

Describing this portion of the budget as “You Inc,” Pape describes living expenses as how much it costs you to “keep the lights running and the kids from drinking out of the dog’s bowl.” This includes things like housing, utilities, transportation, insurance and food.

Savings = 20%

Noting that many people don’t allocate enough for their savings, Pape recommends starting by saving $2,000 in what he calls a “Mojo account” (this is basically an emergency fund). Afterwards, 20% of your income should be used to pay off your debts one at a time.

Splurges = 20%

Per Pape, this percentage should be put towards “things that make you smile.” Nights out, vacations, hobbies and entertainment all fall under the splurge category.

60/20/20 vs 50/30/20 Budgets – Which is Better?

These two budgeting strategies are incredibly similar. The biggest difference is a 10% shift between living expenses and splurges.

Where is the best place for that tenth of your income to be spent? The answer will be different for everyone depending on their unique situation, but here are some considerations that can help you decide which category to prioritize:

60/20/20 may be better if…

- You live in a place with a higher cost of living

- Your splurge spending would only be for you

50/30/20 may be better if…

- You live in a place with a lower cost of living

- Your splurge spending would cover other family members besides yourself

How to Utilize the 60/20/20 Budget Rule

Need help getting started? Follow these five steps to follow the Barefoot Investor budget:

- Determine your total take home pay. Add up your primary source of income and any additional earnings from freelancing or side work. If you combine your finances with a partner, don’t forget to include their income as well.

- Track your current budget. Record your monthly bills and expenses. If certain spends vary from month-to-month, like utilities or groceries, a monthly estimate is fine. Categorize each of these as a living expense, splurge or savings and debt repayment. Once you’ve listed where your money is currently going, you can better decide what to keep the same and what to reprioritize.

- Allow 60% of your take home pay to be spent on living expenses. This category is reserved for the things that you can’t live without, like shelter, food, healthcare, and a way to get to work. If you find yourself spending more than 60% of your earnings on these, it may be time to find creative ways to lower the costs (like getting a roommate, swapping name-brand goods for generics, etc.). You can also look for ways to increase your income, such as securing a higher paying job or a side gig.

- Dedicate 20% of your funds to your savings and debt repayments. To truly follow the advice of the Barefoot Investor, start by saving $2,000 for an emergency fund. Next, prioritize paying down your debts, starting with the smallest and working your way up to the biggest.

- Limit your splurge spending to 20%. “There’s no need to feel guilty about splashing out when you have money in the bank,” notes Pape in his blog. With 80% of your funds going towards your needs and your savings, you can put the rest towards your “wants.”

60/20/20 Budget Examples

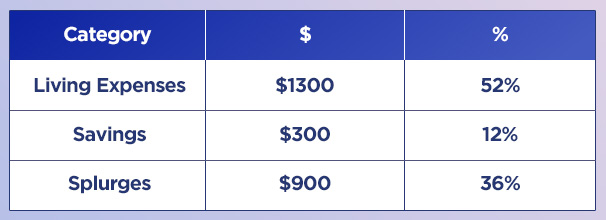

Example A: Tyler

Tyler is new to the workforce, and he lives on his own in a small town. Between his entry-level job and his side business, he takes home about $2,500 a month. His current budget breaks down like this:

Tyler’s budget needs some tweaking to hit the 60/20/20 rule. The best thing he can do is to cut down his splurges and use that money to pay down debts and build his savings. He also has some wiggle room in the living expenses category; if he wanted to, he could upgrade to a new apartment or different mode of transportation. Alternatively, since his living expenses are so low, it may make more sense for him to follow a 50/30/20 budget instead.

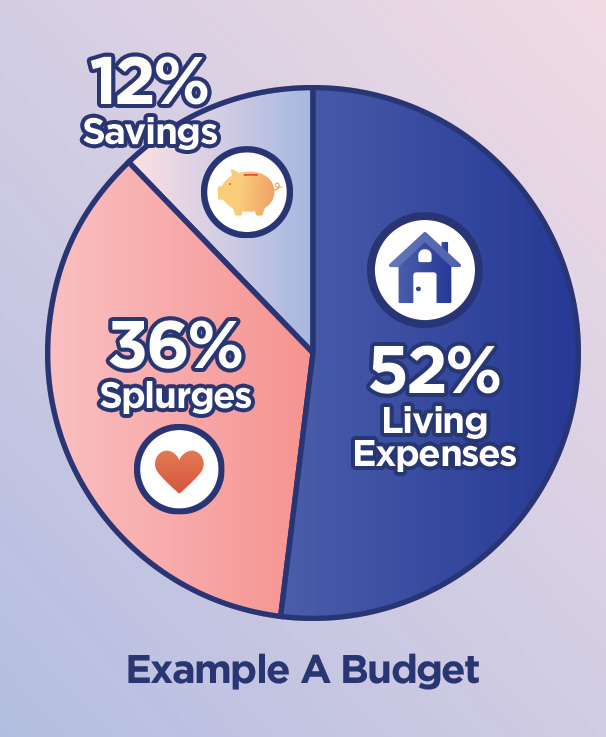

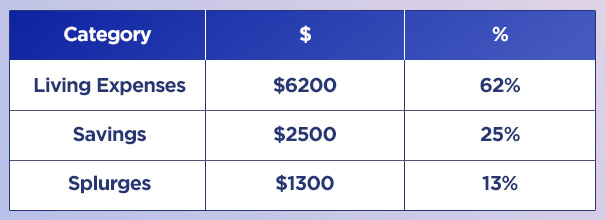

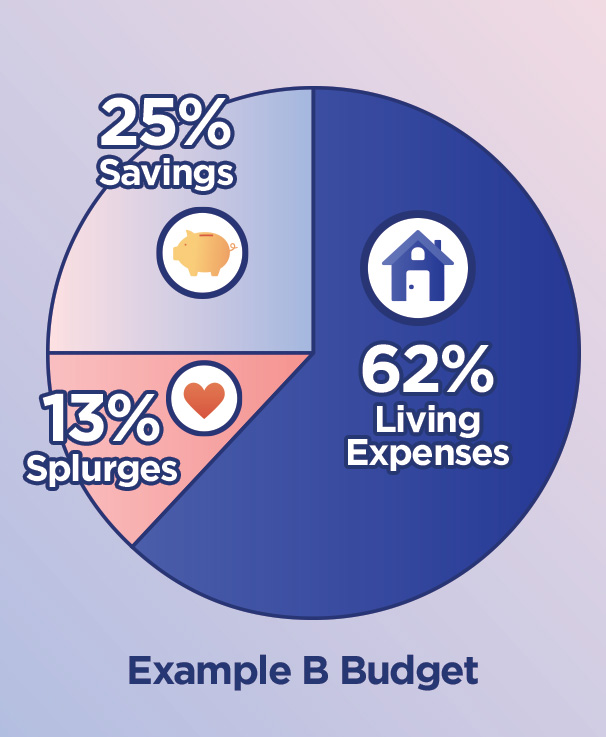

Example B: Sam and Morgan

Sam and Morgan are working parents who live in a big city. Together, they bring home about $10,000 a month. After crunching the numbers, they discover that their budget looks like this:

With mortgage payments, HOA fees, childcare and transportation to juggle, a 60/20/20 budget makes more sense for them to follow than a 50/30/20. Morgan and Sam can bring more balance to their budget by bringing their splurge spending closer to 20%.

More Budgeting Tips to Get Your Finances On Track

There are many ways to tackle a budget — it may take trying a few different strategies before you find the system that works best for you. For more ideas and inspiration, check out these articles:

- Start Budgeting With Our Free Worksheet

- Are Budgeting Myths Holding You Back?

- What Is an Anti-Budget and How Does It Work?

- Debt Repayment Methods: Snowball vs. Avalanche

Updated January 2024