We look forward to the holiday season every year as a time to set aside our worries and focus on celebrating with family and friends. With this in mind, it’s especially important that you make a sound holiday spending budget so that financial concerns don’t get in the way of your fun.

This year our holiday plans and spending are likely to look a little different. Record-setting unemployment rates mean that many families are working with tighter budgets than they have in years past. However, experts predict that holiday spending may not decrease as much as logic would suggest. It is forecasted that holiday retail sales will rise between 1 and 1.5% and that online sales will increase by 25 to 35% from November to January, despite the pandemic.

These projected increases show that the holidays are an important priority for families who welcome a diversion from the many stresses presented by 2020. We agree that the holidays can be a great way to destress this year, and have put together a list of tips to help you get the most out of your holiday budget.

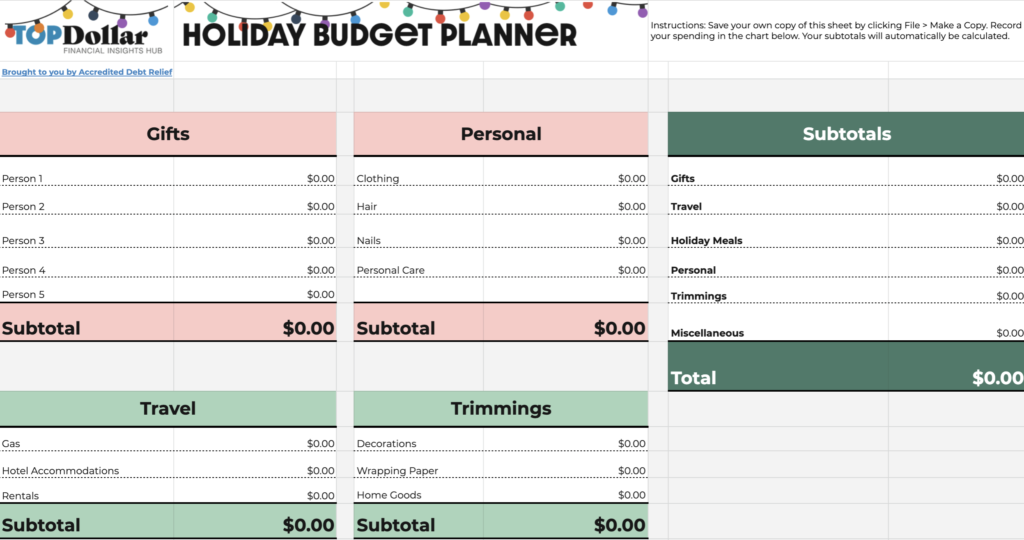

1. Plan Ahead with a Holiday Budget

If you want to get the most out of your holiday spending, then making one is a great place to start! Start by making a list of holiday expenses that includes food, decorations, gifts, travel expenses, extra utility costs like water, gas, and electricity, extra cleaning supplies and PPE, holiday rentals, and anything else you might need. Be sure to leave wiggle room for extras and stay away from making an aspirational budget that will be hard for you to stick. If your budget is too tight you probably won’t be able to stick to it and give up when you inevitably outspend it.

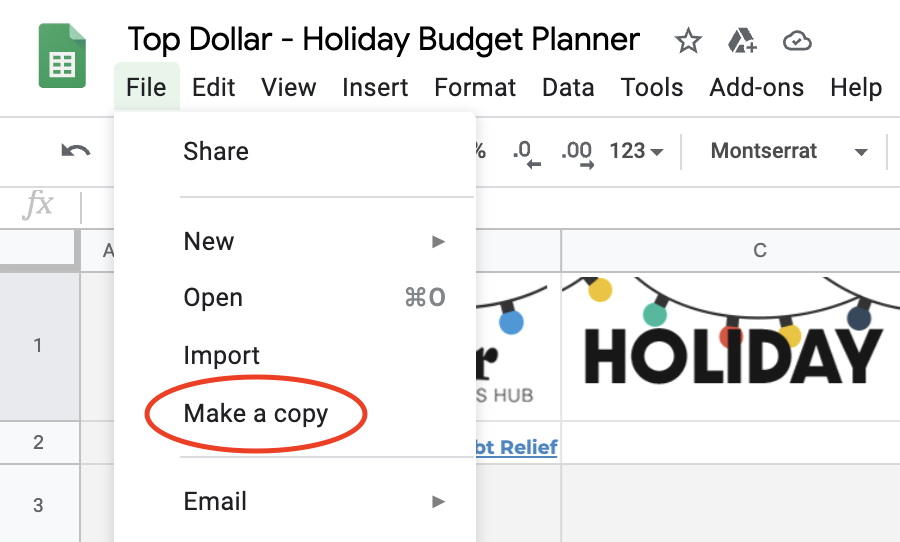

Our copy is locked for editing, but you can save your own version to edit as you please.

If you have a Google account: simply click “File” and “Make a copy” in the upper left-hand corner to save.

If you don’t have a Google Account: simply click “Download” to save the spreadsheet as a PDF or Excel file.

2. Put Decorative Lights on a Timer and Upgrade to Energy-Efficient Bulbs

The cost of holiday lights running 7 hours or more per day from Thanksgiving to New Years is going to add up. Did you know that a typical indoor tree has 5 strings of lights, 100 bulbs for every 1.5 feet of Christmas tree? Depending on the type of bulbs you are using, 1 string of lights with 100 mini bulbs will use approximately 45 watts per strand. The cost will vary depending on the type of lights you use.

The Cost of Running Christmas Lights 7 Hours per Day

Indoor Tree

450 watts at 7 hours a day for 45 days at $0.12 per kWh= $17.01

Outdoor String Lights

10,000 watts at 7 hours a night for 45 days at $0.12 per kWh= $378.00

Outdoor Tree Lights

14,000 watts per tree x 2 trees at 7 hours a night for 45 days at $0.12 per kWh= $529.20

Decorations/Accessories Requiring Electricity

240 watts at 7 hours a day for 45 days at $0.12 per kWh= $9.07

Icicle Lights

18,168 watts at 7 hours a night for 45 days at $0.12 per kWh= $686.75

Turning off your lights can save you money, as can swapping out incandescent lights with energy-efficient LEDs. If you want to automate your lights there are many light timers that can be attached to your outlets and will turn your lights on and off at preset time intervals so you can set it and forget it.

3. Cut Back on Extras

Little extras here and there can add up, and that’s one of the ways many people outspend their holiday budget. For example, you may be thinking about how much you plan to spend on a holiday gift shopping spree, but have you factored in the cost of expensive coffees and eating out between stores?

Try cutting out some of these extra expenses:

- Skip expensive lattes and food while you are out shopping

- Shop nearby or online to cut back on gas costs

- Recycle last years decorations rather than buying new ones

- Skip professional gift wrapping (unless it’s a free service!)

4. Try to DIY Before You Buy

Add a personal touch to your holiday festivities by focusing on food, decorations, and gifts that you can make yourself. The internet is full of DIY resources, recipes, and instructions for all skill levels. Just make sure that you choose projects that are appropriate for you and don’t require expensive tools you don’t already have on hand. Lastly, before you commit to DIY projects you’ll want to confirm that it will actually save you money. While some people DIY only for the fun of it, if you are doing so to save money, it’s a good idea to make sure you can’t buy something for less than it would cost to make it.

Check out these ideas for DIY decorations and gifts that everyone will love:

5. Compare Prices with a Pricing App

Getting a deal on something is fun! Sometimes finding something on sale can even give you a mood boost. Researchers have found that shopping a sale can give you a dopamine rush because your brain is anticipating a reward. Stores know this and have their own fun with this psychology by running sales that aren’t really a good deal. Some stores will label items with sale signs, but prices will remain the same or only be a few pennies cheaper. If you want to be certain that your sale find is a good one, consider downloading a price comparison app that will allow you to scan the items barcode and price check in on the spot. You’ll know right away if your deal is a good one, or if you can get your find somewhere else for a better price.

We checked out a few apps and like ShopSavvy.

6. Simplify Your Holiday Menu and Shop Your Pantry

We can all agree that holiday celebrations are better with food and lots of it! You may even find yourself making more than you need. This year it’s ok to scale back and simplify your holiday menu to a handful of favorites. This will help you save money and cut back on food waste or an abundance of leftovers that will encourage you to overeat.

We recommend planning your menu in advance and making a shopping list of items to avoid temptation at the grocery store. Before you buy groceries make sure you shop your pantry and clean out your fridge. You might be surprised by what you already have on hand.

If you are on a tight budget but typically host your get-together, consider asking friends and family to help out by bringing food and drinks to share. Although our gatherings are likely to be smaller this year it’s ok to ask your guests to help out with the holiday preparations.

7. Start Shopping Early

If you are a classic last-minute shopper you may want to rethink that strategy this year. Some major retailers plan to release their holiday sales early. Stores are adapting to the pandemic by making their Black Friday deals available in October. That means sale items might sell out sooner than expected.

For example, Home Depot plans to run Black Friday deals for two months and Amazon plans to release their deal a month early, starting on October 26.

Don’t Let FOMO Break Your Budget

FOMO, fear of missing out, is what happens when you make choices based on what other people are doing rather than what you feel inspired to do. While it’s ok to be influenced by the things that you see online, it can get out of hand quickly if it causes you to have unrealistic expectations about what you need to enjoy the holidays. FOMO can cause your holiday budget to break down if you become convinced that you need expensive gifts, clothing and decorations in order to have fun this season. Instead, try to focus on creating a holiday experience that is unique to you and the things you value most.

Focus on What Matters Most

While material things can help us have a good time and may be integral to certain traditions, you can keep your material needs in perspective by reflecting on what you love most about the holiday season. What could you truly not live without? If you answer honestly, you’ll probably realize that your list is short and includes the people you love and care about rather than things that can be bought at a store.