Summer is almost over, and that means back-to-school season is around the corner. Use our back-to-school budget spreadsheet to plan for your child’s school expenses and follow five tips to save money on your list.

Quick Links

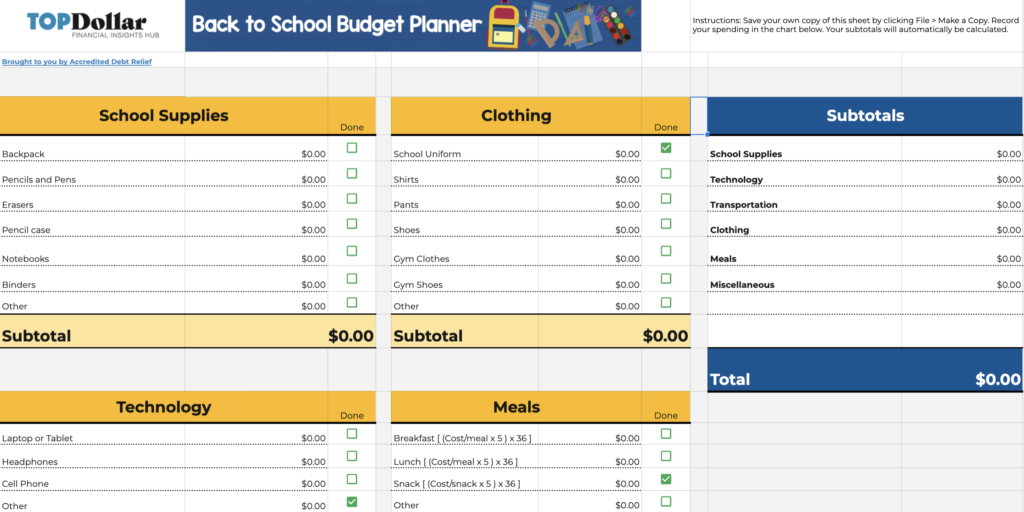

Download: Back-to-School Budget Planner

6 back-to-school Money Saving Tips

Plan Ahead With a Back-to-School Budget

Download our back-to-school budget spreadsheet to plan ahead.

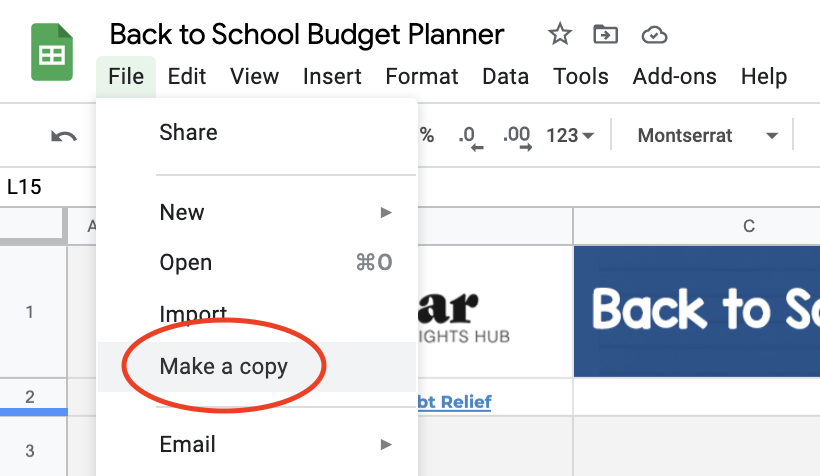

Our copy is locked for editing, but you can save your own version to edit as you please. Simply click “File” and “Make a copy” in the upper left-hand corner to save.

Follow 6 Back-to-School Money Saving Tips

We talked to parents and teachers all over the country to find their most unique tips. Here are six unique ways to save money on your back-to-school shopping.

1. Plan a Supply Swap

Instead of purchasing large quantities of new items that you may not use, a supply swap lets you partner with other parents or teachers to share savings before you start shopping. Contact the communities you are already involved in both off and online to see if they are hosting a swap.

If no one is currently hosting, pitch the idea to community leaders and get involved in helping organize the event. This can include playgroups, church groups, sports teams, neighborhood, or your local Girl Scouts just to name a few.

“From lightly used sports equipment to outgrown uniforms and clothing, a supply sway can make a dent in your list and spend some social time with the people and families you enjoy.” – Holly Reid-Toodle, The Master Playbook

“For example, you might have reams of loose-leaf paper you purchased on sale, but you’ll never utilize it all. While your friend might have various packs of pencils or a pencil case they’d like to trade for some of that paper. Communicate to friends and family members with school-aged children and see if they have extra stocks they’d be interested in trading.” – Huzaifa Usmani, Scooter Guide

2. Check Online Marketplaces for Second Hand Items

“My #1 tip for saving money on a back-to-school budget (for parents and/or teachers) is to check Facebook Marketplace. As a parent, I have found great deals on gently used clothing for my children. As an educator, I have found everything from storage options, books, school supplies, decor, and more!” – Jessica Garza, The Primary Parade

Find gently used or like-new items on Facebook marketplace, Craigslist, Offerup, Mercari and more. Buying second-hand can save you a lot of money and is also an ecologically conscious choice!

3. Comparison Shop for Big-Ticket Items

Time is money and time is something you may not have as much of as the start of the school year approaches. It’s easy to stress over the cost of everything you buy, but don’t get hung up fixating on the price of smaller items.

Instead of stressing over the price of glue, focus your comparison shopping energy on big-ticket items where the savings are greater.

“You only have enough time and energy. You’re better off using your energy to save money on bigger-ticket products, particularly electronics like computers and tablets. Saving $300 on your high schooler’s latest laptop means more to your resources than saving $10 on your middle schooler’s lunch box or 50 cents on a bottle of glitter glue. Adjust on saving money on your most vital expenses first, and let the glue take care of itself.” Jason Richardson, MCS Rental Software

4. Use a Cashback App

Like a cashback rewards credit card, cashback apps reward you for purchases that meet certain conditions. Look for apps that offer rewards at the places you plan to do most of your back-to-school shopping.

“These sites offer savings for online and in-store shoppers, and some of them even run back-to-school campaigns for extra savings. For example, Ibotta is currently offering 100% cashback on select school supplies like notebooks and snacks.” – Dylan Houlihan, Swift Salary

5. Use Up Last Year’s Supplies and Wait for September Deals

Before you go on a shopping spree, take an inventory of last year’s unused supplies. You’ll want to use these up before you buy new things. School supplies go on sale in September, so consider getting the basics in August and stocking up when things go on sale in September. This also lets your student take stock of which items on their supply list are actually needed, as things tend to change once school gets underway.

“If you can wait until after the back-to-school rush has passed to make these purchases, you may be able to get them at a discount. Keep an eye out for sales which tend to go out in September. They’re an excellent opportunity to stock up on goods that you’ll need throughout the year, such as pencils and paper. If there’s anything you forgot or didn’t think of, you’ll have time to acquire it later.” Lee Grant, Wrangu

6. Take Advantage Of Your State’s Sales Tax Free Holiday

“Taking advantage of the tax-free holidays can help save money on a back-to-school budget. Fifteen states offer tax-free holidays on school supplies for 2021. Supplies could include computer equipment, calculators, backpacks, clothing, paper, pencils, etc. These savings can add up, and you can end up saving between $5 and $70 per item. Savings will depend on the particular item because limits are imposed at a specific dollar amount.” – Annette Harris, Harris Financial Coaching

Sales tax free holidays are already underway for the 2021 back-to-school season. Iowa, Missouri, New Mexico, Ohio, Oklahoma, South Carolina, Texas, Virginia started their tax free holiday on August 6th, joining Florida which has 10 tax free days that started on July 31st.

Arkansas’ holiday starts August 7th, and Maryland’s tax-free week begins August 8th. Connecticut and Massachusetts offer tax breaks later in August. Alabama, Mississippi, Tennessee, West Virginia already held tax holidays over the summer.

Even people without children can get in on the tax savings, but criteria may differ from state to state. Online shopping also is tax-free during the tax holiday.

Budget for Unexpected Expenses

School-provided shopping lists are a great place to start but plan on other expenses coming up throughout the year. School projects, sports equipment, class trips and more can all add up. Set aside some funds every month to cover these expenses. You can even encourage your student to be a part of the savings process and turn it into a teachable moment.