If you are looking for a way to mix things up and make saving more fun try an envelope challenge! The saving method can be customized to meet your needs and involves putting cash into envelopes at regular intervals until you’ve met a savings goal.

How Does an Envelope Savings Challenge Work?

The envelope challenge is a simple saving method where you take envelopes and add cash to them every day, week, or month to accumulate funds.

There are many variations of the challenge, but one of the most popular is the 100-day envelope. Check out how to do a 100-day envelope challenge along with two other variations that could help you save anywhere from $465 to $10,000!

3 Reasons to Start an Envelope Challenge

Savings challenges are a great way to jumpstart an emergency fund or save for a special purchase. They are also a great way to build good money habits.

- Save for an emergency fund

- Jumpstart a savings goal

- Save for a special purchase or vacation

Top 3 Envelope Savings Challenges

#1: The 100-Day Envelope Savings Challenge

#2: The 52-Week Envelope Savings Challenge

#3: The 30-Day Envelope Savings Challenge

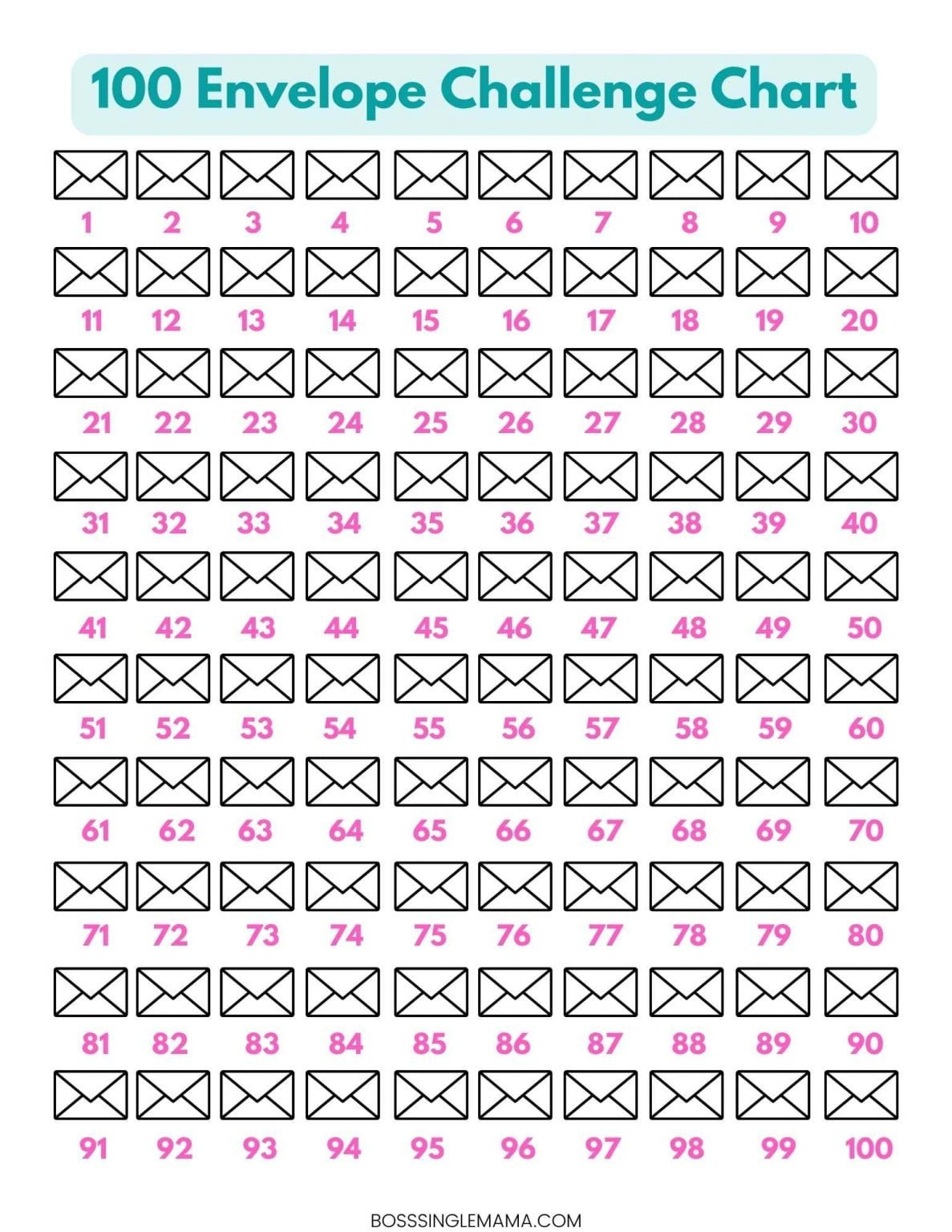

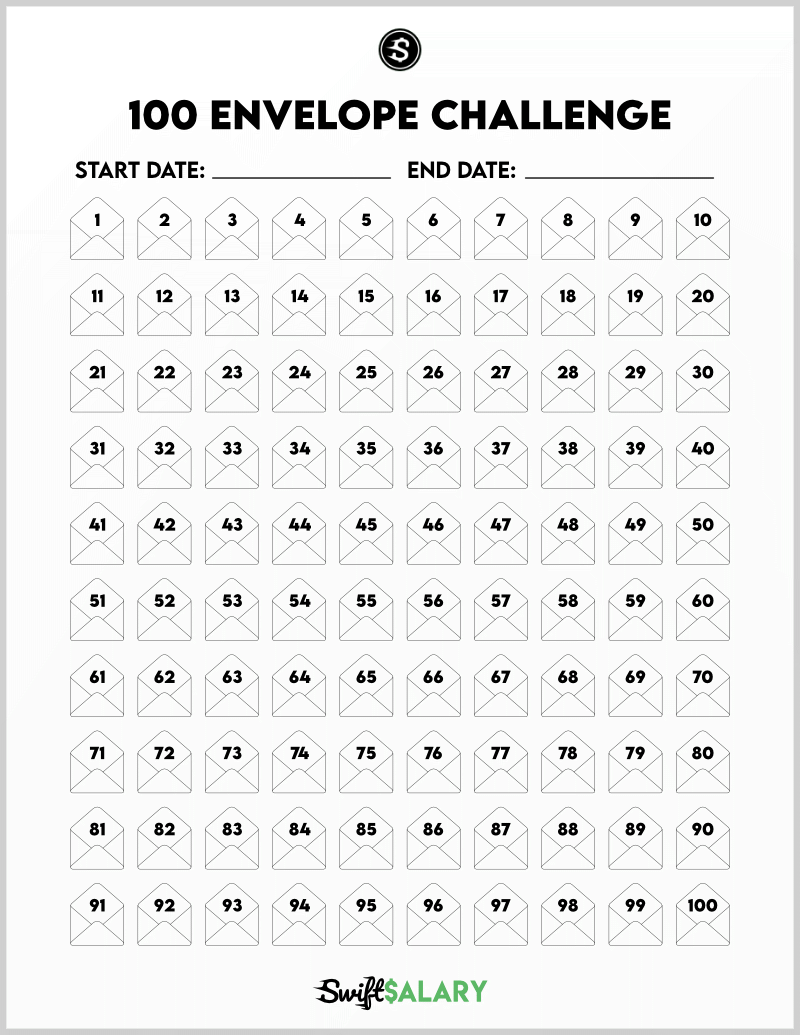

#1 The 100-Day Envelope Savings Challenge

| Save: | $5,050 |

| Step One | Get 100 envelopes |

| Step Two | Write the numbers 1 to 100 on each envelope |

| Step Three | Every day for 100 days choose an envelope at random and place the amount written on the envelope inside |

| Step Four | Repeat this process every day for 100 days |

| Step Five | Complete the challenge and save $5,050 |

What to know!

- The challenge last 100 days

- You need 100 envelopes labeled 1 to 100

- You save money in envelopes every day based on the number on the envelope you draw.

- You can go in numerical order or pick envelopes at random each day.

- A typical 100-day challenge saves you up to $5,050

#2 The 52-Week Envelope Savings Challenge

| Save: | $1,378 to $10,000! |

| Step One | Get 52 envelopes |

| Step Two | Write the numbers on each envelope based on the amount you plan to save. |

| Step Three | Every week for a year, choose an envelope at random and place the amount written on the envelope inside. |

| Step Four | Repeat this process every day for 52 weeks. |

| Step Five | Complete the challenge and save $1,378 to $10,000 |

What to know!

- The challenge last 52 weeks or a whole year

- You need 52 envelopes

- You save money in envelopes every day based on the number on the envelope you draw.

- You can go in numerical order or pick envelopes at random each day.

- A typical 100-day challenge saves you from $1,378 or $10,000, depending on which version you try.

#3 The 30-Day Envelope Savings Challenge

| Save: | $435 |

| Step One | Get 52 envelopes |

| Step Two | Write the numbers 1 to 30 on each envelope |

| Step Three | Every week for 30 days, choose an envelope at random and place the amount written on the envelope inside |

| Step Four | Repeat this process every day for 30 days |

| Step Five | Complete the challenge and save $435 |

What to know!

- The challenge lasts 30 weeks or one month.

- You need 30 envelopes.

- You save money in envelopes every day based on the number you draw on the envelope.

- A typical 30-day challenge saves you up to $465.

Make The Envelope Challenge Your Own with Our Tips!

Money savings challenges tend to work best when you can customize them to meet your needs. The envelope challenge in this blog is no different. Follow our tips to tweak the challenges and make them more accessible for your budget or lifestyle.

Our Tips!

- Instead of using physical envelopes, write out the daily amount on slips of paper and put them in a jar. Pull one slip per day to find out how much to add to one large envelope, money bag, or piggy bank.

- Go digital! Place the amount you draw each day into a special savings account.

- If the savings amounts are not in your budget, pick a new goal and split it up amongst the envelopes.

Learn more about creating a budget or starting an emergency fund with our guides:

6 Tips to Save For An Emergency Fund

Start Budgeting With Our Free Worksheet