Have debt? You’re not alone. 8 out of 10 Americans reported having some debt in 2020. Debt isn’t inherently bad, in fact, it can be a necessary tool to get an education. It can also help you build your credit and can be useful when you want to finance large purchases. However, the type and amount of your debt make a big difference in assessing your financial health. Complete this form to find your debt-to-income ratio and learn about your risk. Results can help you decide if you need a debt solution and which one might be right for you.

Debt-to-Income Ratio (DTI)

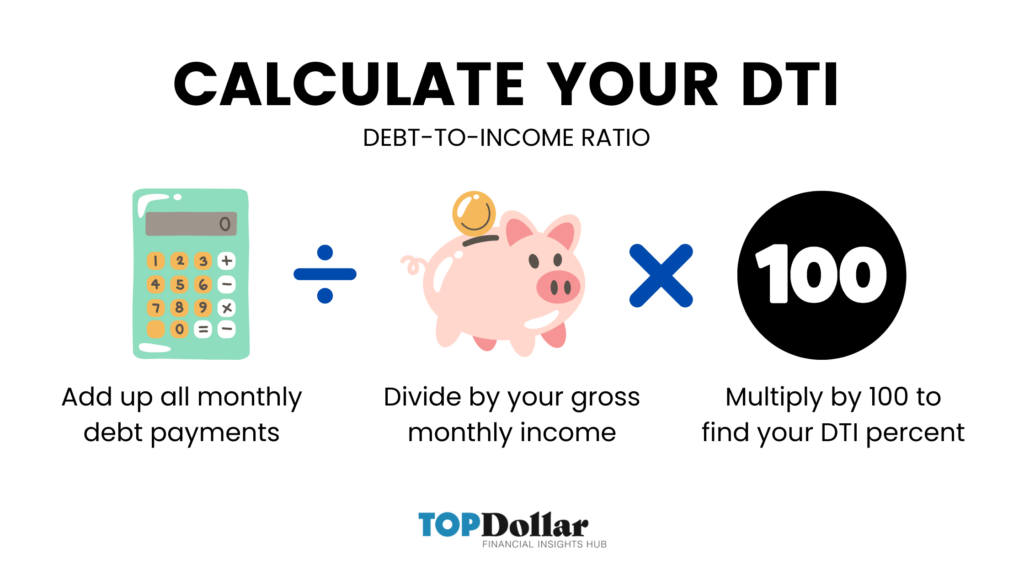

The debt-to-Income ratio (DTI) measures how much debt you have compared to your income. It is calculated as a percentage and the lower the number, the better your score.

Total Regular Monthly Debt Payments ÷ Gross Monthly Income = Debt-to-Income Ratio

If you have a high DTI percentage you are a higher risk for lenders because you may be over-extended with more debt than you can realistically handle.

Calculate Your Debt-to-Income Ratio

Complete this form to calculate your debt-to-income ratio and learn about debt solutions that are right for you and your debt.

Low Risk: Less than 28%

Your debt-to-income ratio is under 28% which means that you are considered low risk by most lenders.

While your debt is most likely manageable, you can simplify it with a debt consolidation loan. Debt consolidation will combine your monthly payments, and depending on the interest rate and terms could help you save money and pay down your debt faster.

Average Risk: Back-end 29% to 42%

Your debt-to-income ratio is between 29% and 42% which means that your risk is considered average by most lenders.

Although you have an average amount of debt, you can still save on your monthly payments, and pay off your debt faster using a debt consolidation option. You might be eligible for several debt solutions that could combine and lower your eligible monthly payments by 40% or more.

High Risk: 43% or more

Your debt-to-income ratio is over 43%, which means that you are considered high-risk by most lenders.

You will find it difficult to qualify for new debt and may feel overwhelmed by the debt you already have.

Debt consolidation can help you pay off your debt faster than making minimum payments. You can also save money right away with a combined monthly payment that could save you 40% or more on eligible debts.

Front-End vs. Back-End Debt-to-Income Ratio

There are two types of DTI used by lenders. Back-end DTI is the most common, and the label is typically dropped when discussing it because it is considered the default type. Front-end DTI is a common variation that lenders use to assess an individual before issuing a mortgage or line of credit.

Front-End DTI: This is sometimes called the “household ratio” and is calculated by dividing your household expenses by your monthly gross income.

Back-End DTI: This ratio is considered the default for DTI calculations. It divides your monthly debt payments and your monthly household expenses by your monthly gross income.

Lenders often use both front-end and back-end calculations to see if you qualify for a loan. The numbers will be expressed in a pair i.e. 23/35.

Lenders usually prefer a front-end DTI of no more than 28% and a back-end DTI of no more than 36%. Lenders may make exceptions for borrowers with exceptional credit. 43% is considered the highest back-end DTI a borrower can have and still qualify for a mortgage.

Moving Beyond Debt: What to Do When Debt Becomes Too Much

If your result is over 43%, that means that you are considered high-risk by most lenders. You may find it difficult to qualify for new debt and may feel overwhelmed by the debt you already have.

Contact a Consolidation Specialist for a free quote to see if you qualify for a debt solution.