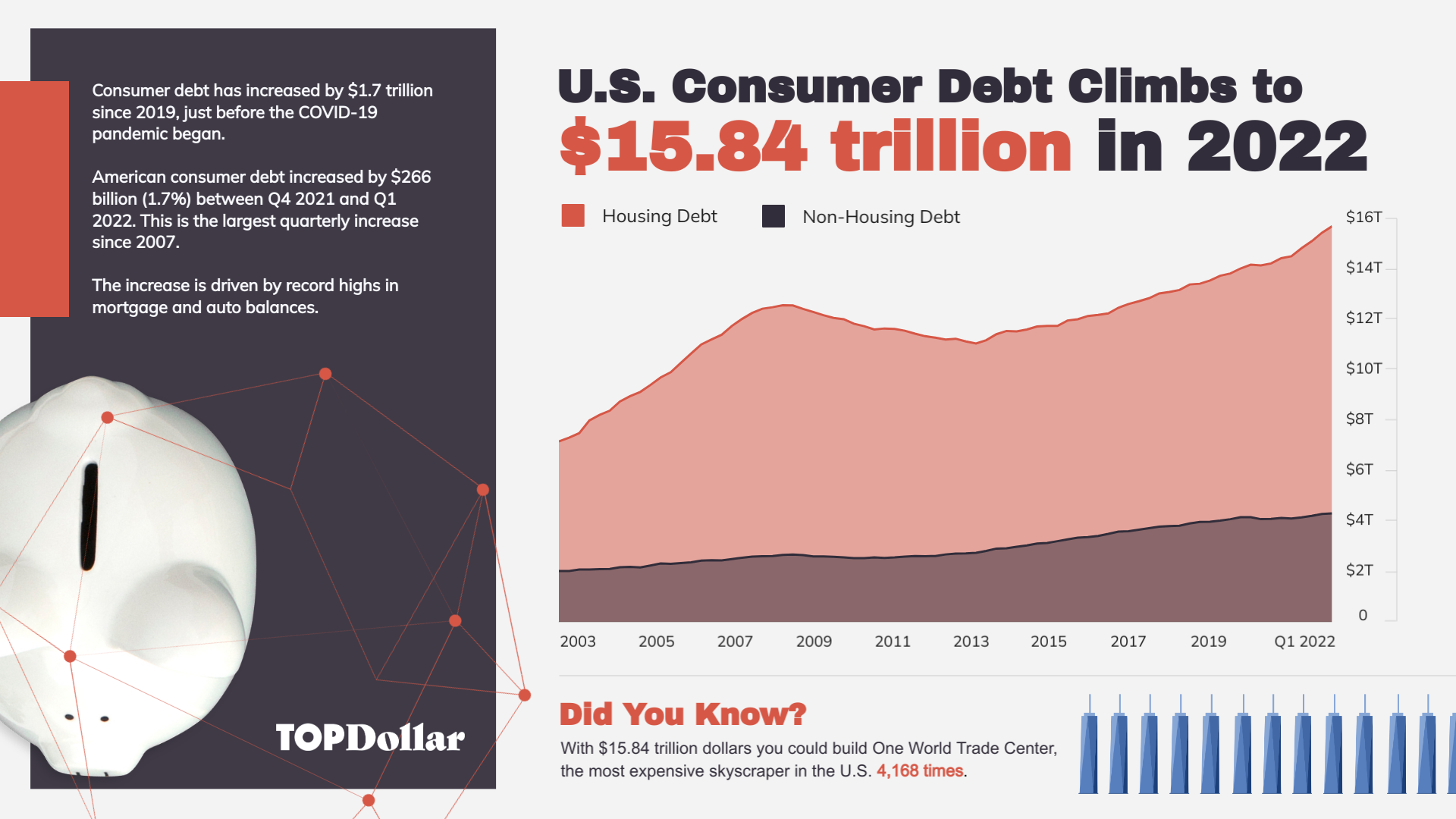

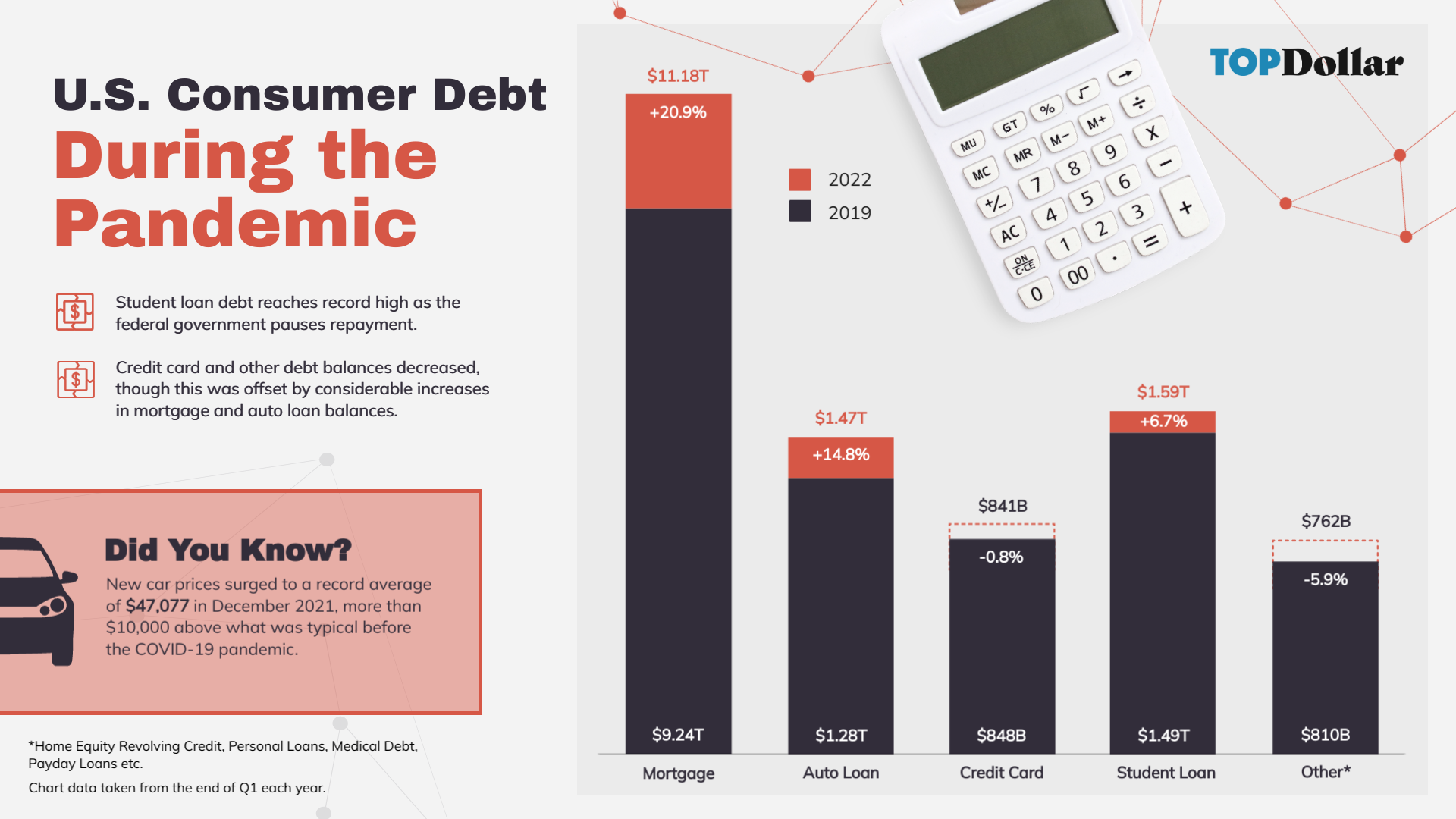

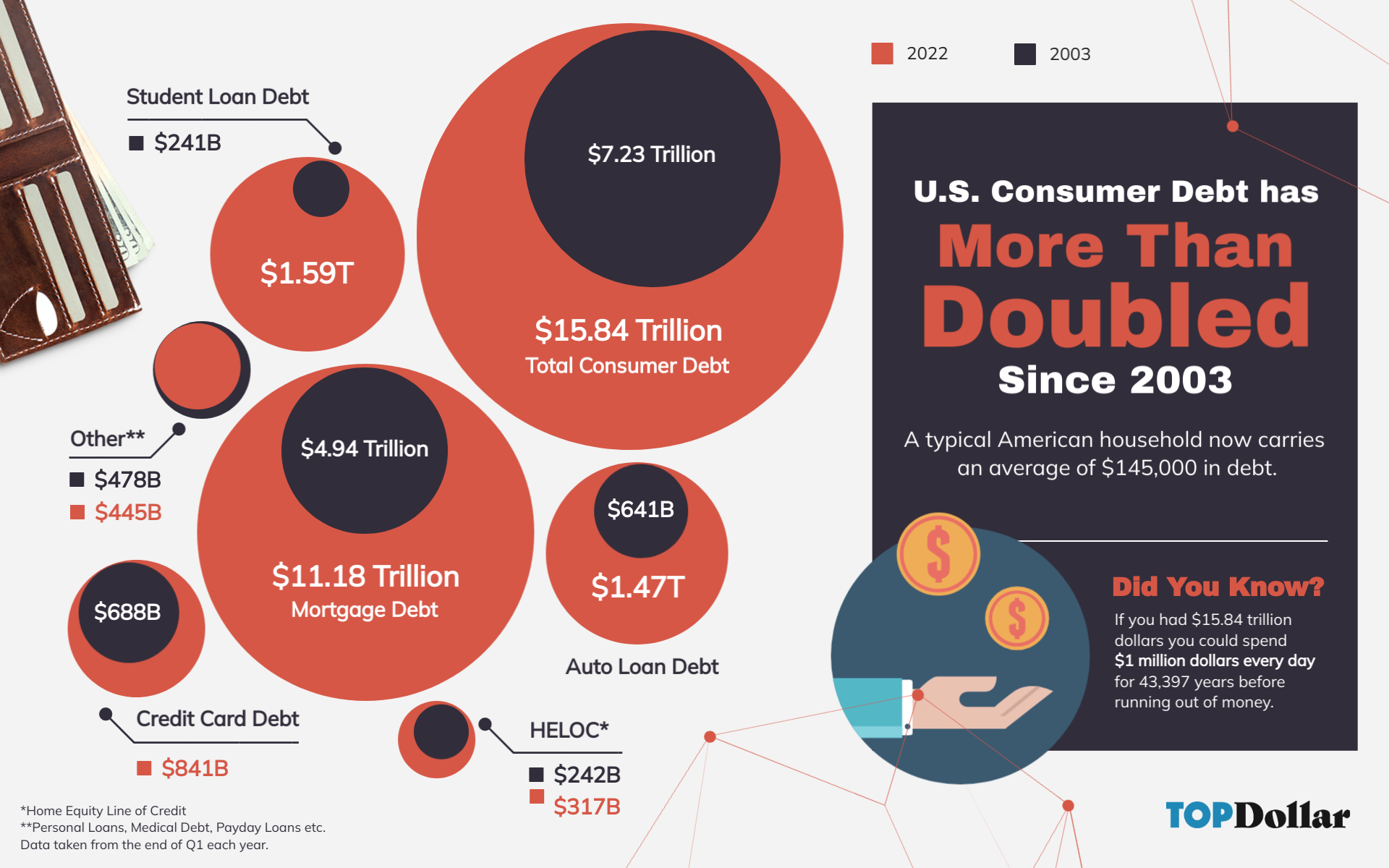

Despite significant economic improvement in 2021, consumer debt in the U.S. has once again hit an all time high. By the first quarter of 2022 it climbed to $15.83 trillion – more than double what it was in 2003 and 20.9% higher than the total pre-pandemic.

Data from the Federal Reserve Bank of New York shows big increases in mortgage and auto loan balances since the pandemic began, despite recent declines in credit card debt. As inflation increases the cost of goods and services, credit card balances are expected to climb. Check out the data below to see how consumer debt has changed since 2003.

What is Consumer Debt?

Consumer debt includes any money borrowed and owed to a lender by households (not businesses) including loans and lines of credit.

Mortgage and Auto Loan Balances Drive Increases

The increase is led, in part, by mortgage and auto loan balances which surged during the pandemic. These increases offset a decrease in credit card balances which began in 2020 and continued early this year.

According to Andrew Haughwout, Director of Household and Public Policy Research Division at the New York Fed:

“The first quarter of 2022 saw an increase in mortgage and auto loan balances coupled with a typical seasonal decrease in credit card balances.”

Credit Card Balances Are Likely to Rebound After Mid-pandemic Decrease

Credit card balance decreases during the pandemic were a good sign for consumer financial health, as this debt tends to have higher interest rates and is riskier than secured debts like mortgages and auto loans.

However, according to Ted Rossman, a senior industry analyst at CreditCards.com, the decreases will be short lived as the world rebounds from the pandemic:

“There’s a good chance that Americans’ total credit card balances will soon reach a new record high, marking a sharp reversal from the precipitous drop that occurred in 2020 and early 2021”

Though the pandemic is still ongoing, the world has largely re-opened and with that comes an increased demand for goods and services. Surges in demand paired with supply chain issues caused by the Russian invasion of Ukraine have had a global impact and driven inflation in the United States.

Inflation is Driving Increases in Short-Term Interest Rates

Inflation affects both the cost of goods and services as well as interest rates. When inflation increases, prices surge and consumers must lean on credit to close the gap, despite interest rate hikes.

Economists often debate the inevitability of inflation in a free market. As far as consumers are concerned, it was the defining macroeconomic event of the second half of the 20th century and history is poised to repeat itself.

Inflation hit an all time high in 1982 and upended how economists viewed Federal Reserve policies. Now, 40 years later we have hit a new inflation record. In April 2021, inflation broke a 40 year record and led the Federal Reserve to increase interest rates by half a point, the biggest jump in two decades.

This time, a surge in inflation is paired with a consumer debt balance that has more than doubled in less than 20 years.

According to Rob Cook, vice president for marketing, digital, and analytics for Discover Home Loans, the cost of inflation is passed along to consumers:

“Persistently high inflation will push the Federal Reserve to raise its benchmark short-term interest rates, increasing costs for lenders, who will pass those costs on to borrowers in the form of higher interest rates”

Consumer Debt Has More Than Doubled in Less Than 20 Years

The average debt held by the bottom 50% of households in the United States has doubled since 2003. Excluding mortgages, the top 1% average just over $500,000 in debt, while the bottom 50% owe on average nearly $37,000.

Households in the top 10% percent but under 1% have the least debt, with an average of just over $23,000.

While inflation accounts for much of the long-term growth in consumer debt totals, converting 2003 dollars to 2022 dollars shows how it has grown beyond inflation.

$7.23 trillion dollars in 2003 is equivalent to $11.21 trillion dollars in 2022. Adjusted for inflation the current consumer debt balance is 41% higher than it was in 2003.

Manage Your Debt Responsibility

If inflation is affecting your budget, be cautious about how much new debt you take on. You can monitor your debt-to-income ratio to make sure your debt is staying within reasonable limits.

Financial advisor, Lisa Fischer concludes:

“As we continue emerging from the pandemic, consumers should work to continue borrowing responsibly, as spending may tick up. There’s nothing wrong with spending on credit, but work to do so in a way that will maintain and improve your credit health. As we emerge from the pandemic and spending habits change or normalize, it can also be a good opportunity for consumers to evaluate finances and spending across the board.”

Already have more debt than you can afford?

If you’re experiencing financial difficulties because you have more debt than you can afford you might benefit from a consolidation option. Accredited Debt Relief has helped more than 300,000 Americans take back control of their finances.

Talk to a Consolidation Specialist to explore your debt consolidation options.