For many, college is a time for brand new starts: new friends, new academic pursuits, new living situations and more. While some of these beginnings might come naturally, others aren’t as straightforward, like budgeting for the first time, looking for jobs or establishing your credit history.

Your credit score is especially important to pay attention to. It can affect your ability to get a credit card or a personal loan, rent a home and be considered for employment. But what do you do if you don’t have a credit score in the first place? Fortunately, there are a few smart moves you can make as a college student that will set your future, degree-holding self up for success.

What Is Credit?

At a high level, credit is the word typically used to describe the amount of trust you can put into someone that they will repay something they’ve borrowed in the future. It comes from Italian (credito), Latin (creditum) and Middle French (crédit) words that describe belief, trust, and entrusting an item to someone else’s care.

In modern personal finance terms, credit is used in a few different ways. Here’s a quick vocabulary list:

- Credit. The money that a lender will let you borrow and pay back based on your prior borrowing history. It comes in different forms, or “lines of credit,” such as credit cards, mortgages and loans.

- Creditor. The service provider, merchant, bank or lender who grants a borrower a line of credit.

- Credit History. The overall documentation of a person’s previous debts and repayments. Think of it as a report card or a transcript showing a person’s borrowing habits.

- Credit Report. The detailed breakdown of a person’s credit history. These are prepared by credit bureaus, which are data collection agencies.

- Credit Score. This is a numerical expression of a person’s creditworthiness, or how likely someone is to pay back a loan. A higher score means that the person is financially more trustworthy and at lower risk of not paying back.

- Credit Inquiry. This is a request to see your credit report information. Credit inquiries are most often made by financial institutions and lenders. They can also be made by employers, insurance companies, utility companies, government agencies, and any entity with a court order. You can also make a request to see your own credit report.

- Soft Credit Inquiry. Also known as a “soft pull,” this type of credit inquiry occurs when a person or company looks at your credit history as part of a background check or to see if you qualify for special offers. If you request your own credit report, it’s considered to be a soft credit inquiry. Soft inquiries don’t affect your credit score.

- Hard Credit Inquiry. Also known as a “hard pull,” these credit inquiries are conducted when lenders make decisions about whether to give a person credit or not. Hard pulls can affect your credit score, especially if multiple hard inquiries are made over a short period of time.

What Affects Your Credit Score and Credit History?

In order to have a credit score, you must have a recorded history of using credit. If you’ve never borrowed money or opened a credit account with a lender who has reported your information to a credit bureau, you won’t have a credit report or score.

When you do begin to take on lines of credit, credit bureaus will receive information about it and create a credit report. Your report will include basic information about yourself, such as your current and previous addresses and social security number. It will also include public records that may be tied to your finances (such as a bankruptcy filing or a lawsuit) and the companies who have asked to see your credit history (like potential lenders, landlords and employers).

The parts of your credit report that determine your credit score include the following:

Why Is Having Good Credit So Important?

A positive credit history and a high credit score are signs that you are a responsible borrower who has a high likelihood of paying back your debts on time. Those with good credit can enjoy perks like these:

How Do I Get a Good Credit Score Without Any Credit History?

Establishing your credit history for the first time can feel like a catch-22. In order to get an offer for a line of credit, lenders typically want to see a history of you using credit responsibly… but you need a line of credit to demonstrate that in the first place!

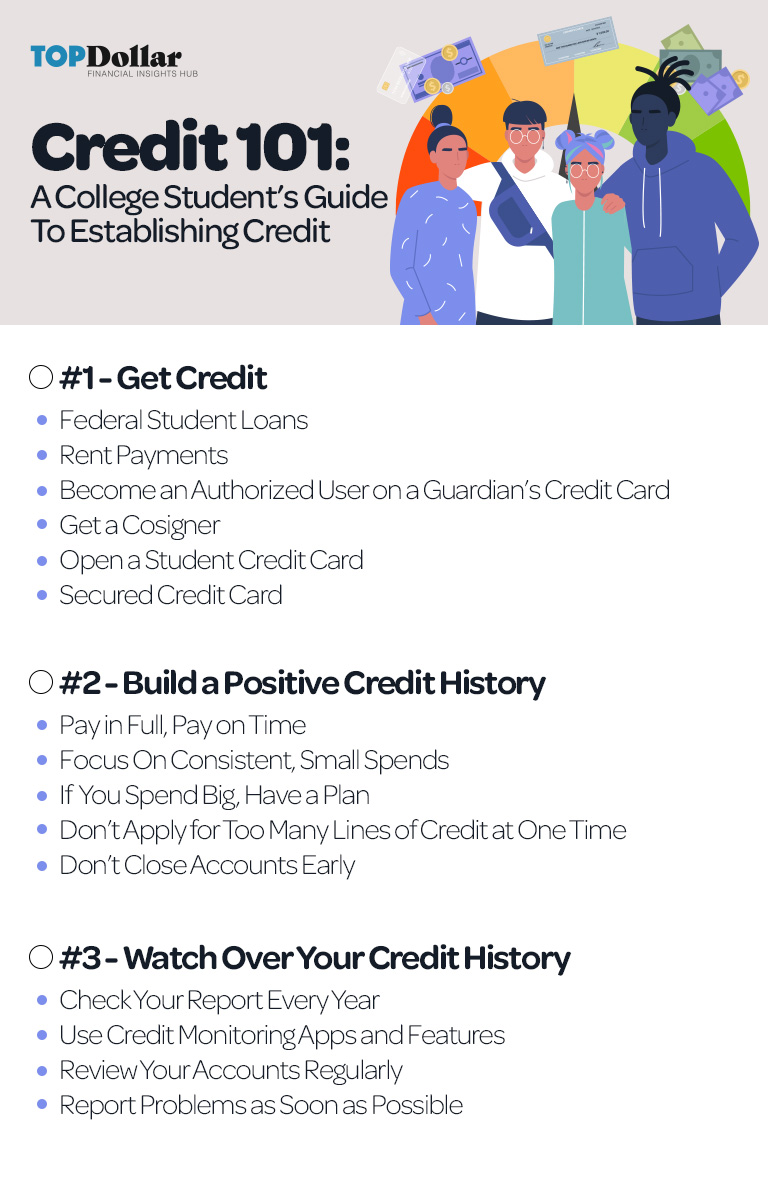

Fortunately, there are other ways to get your foot in the door with credit. Here are the three most important things college students can do to build a solid credit history and improve their credit scores:

#1 – Get Credit

That “have credit to get credit” paradox is easier to get around than it looks. Here are some ways to get credit for the first time:

Federal Student Loans

Credit checks aren’t required in order to get federal student loans, which makes it easier for students to get approved and get cash. You don’t have to wait until you’re out of school to start making payments, either; you can start paying early to get ahead and boost your credit. If you choose to start making payments after you’ve earned your degree, that’s okay too, but make sure you pay on time.

Rent Payments

If you have to pay it every month anyway, why not have your rent work for you as well? You may be able to use a rent-reporting service, which can help build your credit by sharing your rent payment history with credit bureaus.

Check with your property manager to see if they work with a rent-reporting service and if there are any fees to utilize it. You can also work with a service independently, but you may still owe a fee and your landlord will need to verify your rent payments. Additionally, your lease will need to be in your name — not Mom or Dad’s — in order to benefit from this strategy.

Become an Authorized User on a Guardian’s Credit Card

Some credit cards will allow the primary cardholder to add additional users to their card, essentially sharing their line of credit with someone else. This can not only help an authorized card user to build their credit history, but it can also be a great way for people who are new to using credit cards to learn how credit works and how to use it responsibly.

Hopping onto a parent’s credit card is a great way to build your credit, but it requires both you and the other cardholders to work as a team and be on the same page. On-time, late and missed payments will be seen on both the primary cardholder and authorized user’s credit report. Additionally, if an authorized user racks up debt on the card and doesn’t make payments, the primary cardholder is solely responsible for paying it back.

Agree to a spending limit and repayment plan with the primary cardholder before committing to sharing a credit card. Also, be sure to check with the credit card issuer to see if the card’s full payment history will be reported for all users; if credit bureaus won’t see your usage and payment history attached to that particular card, it might be better to use a different tactic.

Get a Cosigner

If you have a trusted friend or family member with a good credit history who’s willing to take a risk, you can apply for a loan or a credit card and add them as a cosigner. Cosigners are different from authorized users; if you don’t pay back the borrowed money, then both of you will be hit with credit score damage and are liable to pay it back. Only go this route if you’re truly ready to foot the bills and keep the responsibility of the card out of your cosigner’s hands.

Open a Student Credit Card

If you truly want a crash-course on credit cards, student credit cards can be a great educational tool. These cards typically have a small spending limit, but they can come with school-related perks, like rewards for good grades.

Make sure you read all of the fine print before committing to a student credit card. Some require a previous credit history. You also might need a cosigner if you’re under 21 or if you don’t have a high income.

Secured Credit Card

Secured credit cards are built for people with bad credit or little-to-no credit history, and they’re fairly simple to use. Rather than being presented with a credit limit based on your credit score, you’ll make a refundable deposit to the credit card issuer who will in turn give you a limit that’s equal or close to your deposit amount.

The whole process is very similar to using a debit card in the sense that you’re spending your own money, except for the fact that you’ll still need to make on-time monthly payments and your activity is reported to credit bureaus. If you do choose to apply for one, be sure to read the fine print and avoid offers with hidden fees and high interest rates.

#2 – Build a Positive Credit History

Once you get your hands on a line of credit, your next step is fairly straightforward: be responsible. Here’s what responsible credit usage looks like:

Pay in Full, Pay on Time

Payment history makes up more than a third of your credit score calculation, which means a solid history of on-time payments can help keep your score healthy. Additionally, carrying a balance month-to-month can leave you stuck owing interest. Set up monthly alerts to remind you when it’s payment time, and do your best to pay off all or as much of the debt as you can.

Focus On Consistent, Small Spends

When you’re extended a line of credit, you may fall into one of two camps:

A) You have the urge to go on a shopping spree or use the borrowed money for a huge purchase.

B) You feel so nervous about taking on debt that you avoid using the card altogether.

Both of these extremes are bad. One can lead to more debt than you can reasonably pay back month-to-month, and the other can lead to limits on your available credit due to underuse. To build a positive credit history, especially when you’re first starting out with credit, it’s best to put your credit towards consistent monthly purchases that are easy to pay back.

Build credit card usage into your routine. For example, you can limit yourself to only using your credit card for a super small purchase you know you’ll make at least once a month, like a pack of gum or a latte. Once you make the purchase and it posts to your account, immediately pay off the card. This strategy works well for both camps; if you’re more of a spender, keeping your card “out of sight, out of mind” except for that monthly purchase can keep you from overspending. If you’re the opposite, a monthly commitment can help ease you into regular credit card use and consistent payment. Either way, you’ll benefit from a great repayment record without putting in too much effort!

If You Spend Big, Have a Plan

Of course, one of the benefits of having a line of credit is being able to borrow more money than you have on-hand. If you need to use your credit card to make a big purchase, like for an emergency payment or a costly necessity, make sure you develop a repayment plan before handing over the plastic.

Don’t Apply for Too Many Lines of Credit at One Time

Credit card and loan issuers make hard inquiries when deciding whether or not to extend an offer. Lenders typically consider multiple hard inquiries in a short period of time as a bad sign, as it looks like the borrower is trying to take on a ton of debt.

If your request for a line of credit is declined, fight the urge to immediately apply for a different one. It’s best to space out your applications and wait three to six months before trying again.

Don’t Close Accounts Early

Let’s say you’ve got a line of credit that’s no longer serving you. Maybe it’s a student credit card with too small of a spending limit or a credit card with an annoying annual fee. Should you hang on to it, or is it time to say goodbye?

Your instincts may say “set it free,” but cutting ties can do more harm than good. Cancelling a line of credit causes a dip in your total available credit and suddenly stops a part of your active credit history — both of which can lower your credit score.

Even if you’re not using a particular line of credit, keeping the account open adds to your credit mix credit mix and boosts your available credit. It might be better to put the card away in a safe and secure place or downgrade your card to avoid annual fees.

#3 – Watch Over Your Credit History

Getting and creating a credit history isn’t enough — monitoring your credit is equally important to building an excellent credit score. Here are some easy ways to ensure your report is in tip-top shape:

Check Your Report Every Year

Did you know that you can get a free copy of your credit report from each of the three credit bureaus every 12 months? An annual review can help you see the overall state of your credit and check that all of your information is accurate. Even if you don’t have a credit history yet, it’s still worth it to check that no one has stolen your identity and opened accounts in your name without your knowledge. Access your yearly reports for free at annualcreditreport.com.

Use Credit Monitoring Apps and Features

Most major credit card apps have monitoring features that provide alerts for suspicious activity and credit score changes. You can also use free apps like these:

- Credit Karma (Apple App Store) (Google Play)

- Capital One CreditWise (Apple App Store) (Google Play)

- Mint (Apple App Store) (Google Play)

Review Your Accounts Regularly

Potential threats to your credit aren’t always hidden on your credit report; they’re often hiding in plain sight on your account statements. Get in the habit of checking in on your account histories regularly to ensure that everything looks accurate. A monthly review can reveal suspicious purchases, doubled transactions and forgotten-about subscription charges — all of which can rack up debt and hurt your credit over time.

Report Problems as Soon as Possible

If you see a discrepancy on your credit report or account statement, don’t wait to act! Dispute any credit report errors and unauthorized credit card charges as soon as possible.

More Collegiate Money Tips

Positive financial habits can set you up for success both now and after you’re done with school. Whether you’re new to campus or preparing to walk at graduation, check out these college-friendly money tips: