If you share some or all of your expenses with a significant other, an effective budgeting strategy is essential for open communication. Using one of our free budget spreadsheets for couples will help you align your priorities and work as a team toward your shared goals.

Try The Right Budgeting Method For Your Relationship

Budgeting is not one size fits all, and neither is budgeting advice! No one knows you or your relationship better than you do. So finding the right budgeting method for your relationship is all about looking honestly at your circumstances.

Start by identifying all the shared expenses between you and your partner. This can include rent or mortgage payments, utilities, groceries, transportation costs, and any other recurring bills you contribute to. Once you have a clear list of these expenses, the next step is to put these into the budget spreadsheet that best fits your needs.

Set aside some time with your partner and read the options below. Be sure to make the decision together, and don’t be afraid to customize and tweak any budgeting method to fit your needs.

Both budget options include areas for shared and individual expenses. How you divide and share these responsibilities will be up to you!

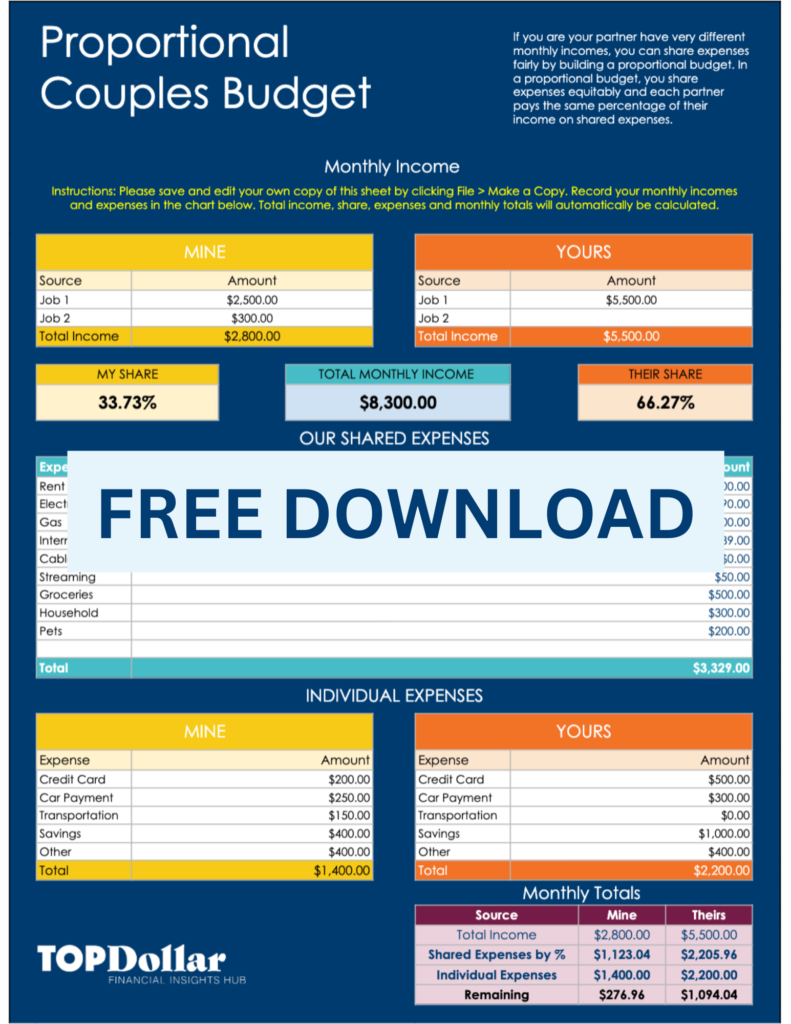

How to Build a Proportional Couples Budget

Equal doesn’t always mean fair. If you and your partner earn different incomes and the gap is considerable, it can make sense to pay for shared expenses proportionally. That means you and your partner agree to contribute the same percentage of your income to your shared expenses so that the burden is shared equitably.

This could be right for you if:

- You are your partner earn very different incomes

- Your relationship is long-term and committed

- You prioritize equity over equality

- It will help you enjoy a higher standard of living without straining one partner more

Download a Free Proportional Couples Budgeting Spreadsheet

Our copy is locked for editing, but you can save your own version to edit! Simply click “File” and “Make a copy” in the upper left-hand corner to save.

The spreadsheet will calculate the total cost of each shared expense and assign a proportional amount to each person based on the percentage of income they bring in. This approach ensures that both partners contribute equitably to the financial responsibilities of the relationship.

A proportional budget can help ensure that one partner isn’t more burdened than the other. It can also help the couple maintain a higher standard of living that aligns with the higher earner’s capabilities without excluding the lower earner’s contributions.

Proportional budgets work well when both partners are comfortable seeing their shared expenses as investments in the relationship. For this reason, it may be better for partners who are married or have made a long-term commitment to each other.

It is important to regularly review and update the budget as circumstances change or new expenses arise.

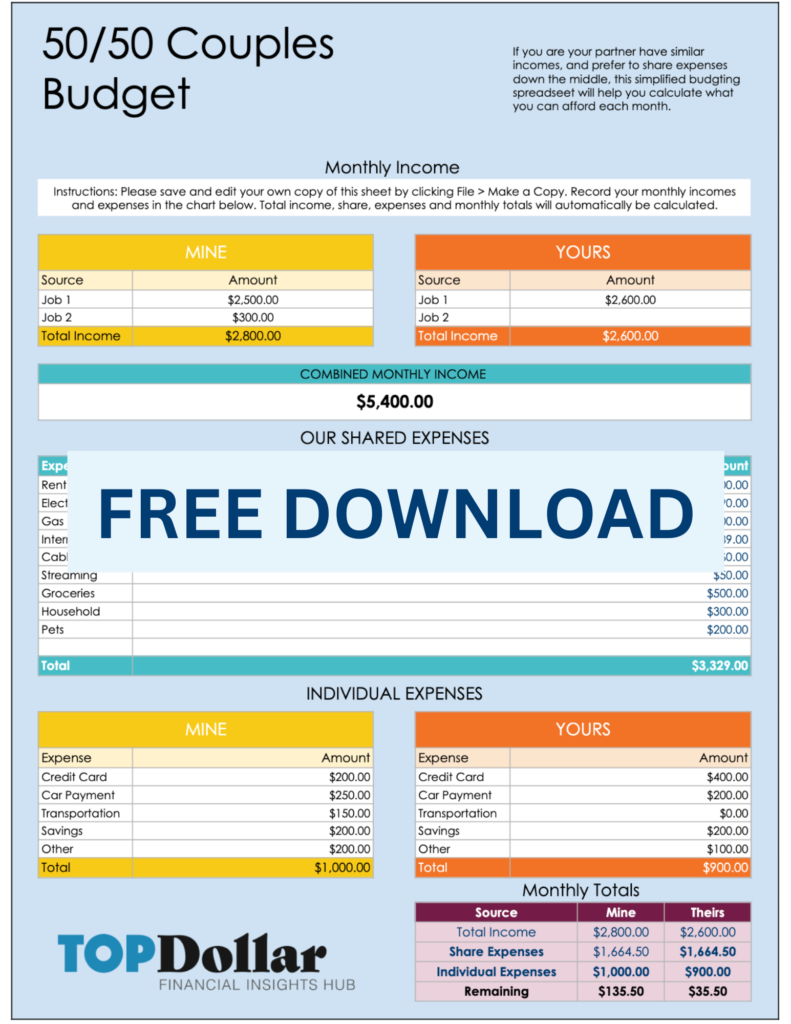

How to Build a 50/50 Couples Budget

This method is more straightforward and involves splitting all shared expenses down the middle.

This could be the right choice for you if:

- You are your partner earn similar incomes

- Your relationship is more casual

- You simply prefer this method

- Your desired standard of living doesn’t strain one partner more than the other

Download a Free 50/50 Couples Budgeting Spreadsheet

Our copy is locked for editing, but you can save your own version to edit! Simply click “File” and “Make a copy” in the upper left-hand corner to save.

The spreadsheet will automatically split all shared expenses and assign half to each partner. There is also plenty of space for individual expenses that will be kept separate.

Splitting things 50/50 with a partner is a traditional approach that mirrors the financial relationship between roommates. When splitting things 50/50, both partners must be honest about what they can afford so no one feels pressured into paying for half of something that doesn’t fit their budget.

Figure Out What You Can Afford – Together!

Two incomes are better than one! Joining forces with your partner can make it easier to afford your needs and wants. But you should be mindful of spending so that lifestyle creep doesn’t eat away at what you could be saving.

Make sure you and your partner are on the same page about priorities. Spending a bit more on the things that matter most to you is one of the advantages of a financial partnership.

Saving is also a considerable advantage. Cutting things like internet and streaming bills in half allows you to pay down debt, save or make investments.

Talking To Your Partner About Money

Does talking about money make you or your partner uncomfortable? If yes, you are not alone. Many people feel uncomfortable opening up about money, especially when there is a history of debt or financial hardship.

The resources below are a great place to start if you want to improve your communication skills. Ultimately, sharing your thoughts, concerns, and goals regarding finances and encouraging your partner to do the same will help build trust and strengthen your relationship.