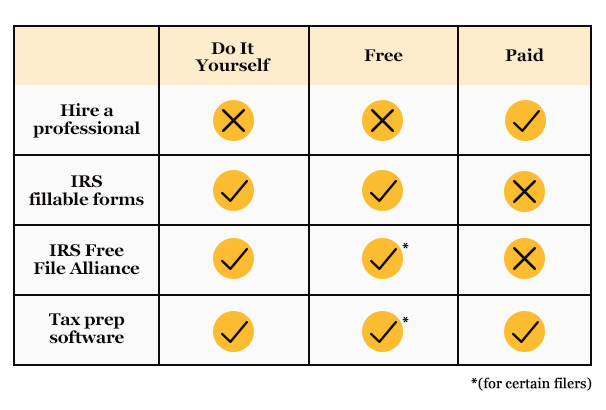

While most people assume it costs money to file your taxes, you don’t have to pay to file. You may find it easier if you do. There are several ways to file your taxes for free. However, taxes are complicated, and the more complex your return is, the harder it will be to find a free method that meets your needs.

Many people choose to pay tax professionals because they don’t have the time, expertise, or interest in navigating the system using a free file method. If you want to file your taxes for free, or are curious what it entrails, start by considering the cost of alternatives compared to free options to decide which method is right for you.

Tax Prep Options

IRS Free File Program

The IRS Free File Program is a public and private partnership between the government and industry leaders in the tax preparation software industry. The program offers taxpayers two ways to prepare and file their federal income tax online for free but is contingent upon income limits.

IRS Free File Alliance Partners

If you make $72,000 or less Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. The service is available to qualifying taxpayers. However, each participating software company sets its own eligibility requirements and may include fees for features that provide additional convenience to the taxpayer. These requirements may vary by state and incorporate other criteria.

According to the Free File Alliance, current members include:

- 1040NOW Corp.

- ezTaxReturn.com

- FileYourTaxes

- Free Tax Returns

- Intuit (maker of TurboTax)

- OnLine Taxes

- TaxACT

- TaxHawk

- TaxSlayer

IRS Free File is a partnership between the IRS and the Free File Alliance, a group of industry-leading private-sector tax preparation companies that have agreed to provide free commercial online tax preparation and electronic filing.

IRS Free File Fillable Forms

Anyone can use the IRS Free File Fillable Forms. The program allows taxpayers to download the forms they need, complete them, and e-file the forms at no cost. To e-file your forms, you’ll need to validate and sign your forms by entering your prior-year Adjusted Gross Income (AGI) or your prior-year Identity Protection Pin.

A taxpayer who chooses this option should know how to prepare their own tax return. It is the only IRS Free File option available for taxpayers whose income (AGI) is greater than $72,000.

Tax Prep Software

Some tax preparation software companies, like former Free File Alliance member H&R Block, now offer free file options outside the context of the IRS Alliance. Much like the alliance partners, the free features only work within specific parameters, and there are extra charges for certain forms and filing options.

How Much Does it Cost to Hire a Professional?

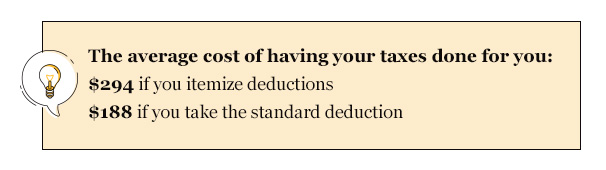

According to an Income and Fees Survey by the National Society of Accountants 2018–2019, the average tax preparation fee to prepare a Form 1040 and state return with no itemized deductions is $188. If you decide to itemize your deductions, the fees increase to $294.

The more complex your financial circumstances are, or the more forms you need to file, the higher the cost will be.

Average Filing Charges by Form

- $187 for Schedule C, for business income

- $109 for Schedule D, for gains and losses

- $136 for Schedule E, for rental income

- $175 for Schedule F, for farm income

- $65 for Form 940, for federal unemployment

- $49 for Form 8965, for health coverage exemptions

- $52 for Form 1095-A, for health insurance marketplace statement

Other Charges

- $62 for Schedule EIC, the earned income credit

- $1,784 for estate tax return on behalf of a deceased taxpayer

- For estates worth more than $11.4M

Source: National Society of Accountants

Should I Pay Someone to Do My Taxes?

Many Americans rely on professionals to do their taxes. According to the IRS, 59% of the more than 134.2 million individual income tax returns e-filed in 2018 were prepared by paid tax professionals. However, that number excludes paper returns or more-complex returns like estates, trusts, or tax-exempt organizations. That means the actual percentage of returns done by paid preparers is likely higher.

People with complicated financial situations may benefit from getting professional help filing their taxes. Still, many can file taxes independently without issue using one of the free options we discussed.

The option you choose will have a lot to do with your unique needs and circumstances. Take our quiz to see which choice could be right for you.

Please Note: This blog shouldn’t substitute professional advice from an accountant. We aren’t qualified to make final decisions about your taxes; only you can do that. We have, however, done broad-based research about tax preparation. The guideposts in this blog can help you consider your options based on specific criteria.