When did you first learn about money, and what were those lessons like? Your memories might include your first piggy bank or an allowance, conversations about saving and spending with your parents, or observing the adults in your life making their own financial decisions.

Whatever your experiences were, it’s likely that much of what you’ve learned about personal finance didn’t come from the classroom. A 2018 study revealed that only 20% of respondents participated in a financial education program at their school, college or workplace.

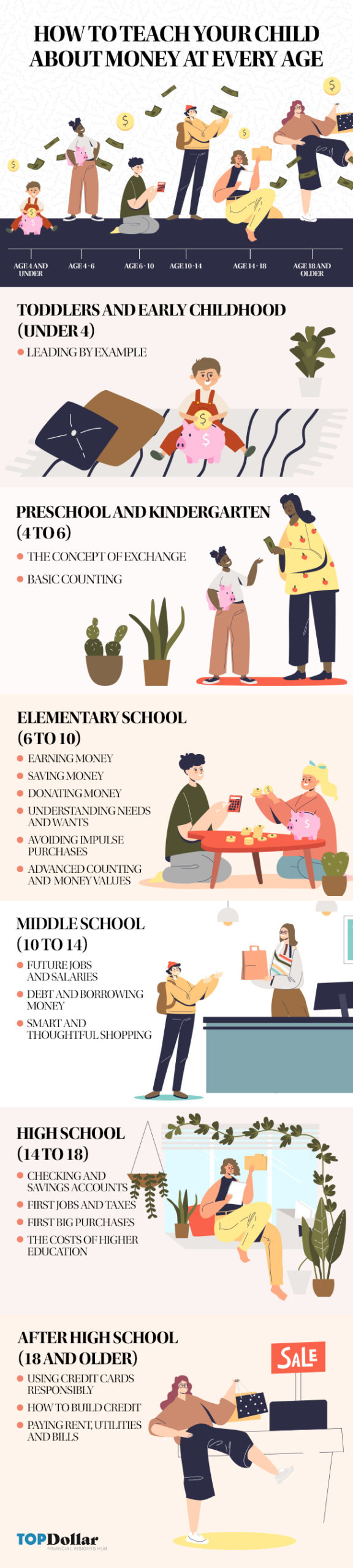

If you want your children to have a quality, well-rounded financial education, you’ll need to start early and help fill in the gaps. We’ve compiled a list of age-appropriate money lessons that can help your kids grow into fiscally responsible adults.

Lessons by Age Group

Toddlers and Early Childhood (Under 4)

Preschool and Kindergarten (4 to 6)

After High School (18 and Older)

Toddlers and Early Childhood (Under 4)

Leading by Example

Young children learn quite a bit about the world through observation. Let your child watch as you run errands, pay for goods, make donations and balance your budget. If they ask “what” and “why,” give them easy-to-understand answers. Your kid won’t comprehend complex economics before they can tie their shoes, but they’ll likely catch onto the idea that things cost money and that adults can work to earn money.

Additionally, you should consider your own financial health and what bad habits your child might pick up from watching you. Behavior experts at the University of Cambridge concluded that many money habits are set by the time a child turns seven. If your child sees you shopping impulsively, putting every purchase on a credit card, struggling to manage your debt or frequently arguing about money with your partner, they’ll likely grow up to do the same.

Preschool and Kindergarten (4 to 6)

The Concept of Exchange

One crucial lesson for this age group is the concept of giving up something in order to obtain another thing. In addition to teaching exchange through pretend and play, your child can learn through hands-on, real-world experience.

Try giving your child a small amount of money to spend at a dollar store or in the toy aisle at the grocery store. Remind them that they can only spend the money once, so they should consider their options and pick out what they really want. Once they’ve made their decision, have them physically hand over the money to the cashier. If they don’t spend it all, let your child keep the change and use it for a future purchase.

Basic Counting

Counting and understanding that numbers mean quantity are fundamental skills that your child can learn over time. Look for opportunities to count objects with them throughout the day. Try counting toys, household items, trees in the park, windows in your house — anything!

Let your child make mistakes and don’t force accuracy. Accurate counting typically doesn’t solidify until ages 5-6, but modeling the counting process and letting them play and explore will still help a great deal.

Check out the below websites for more early childhood counting tips and tricks:

Elementary School (6 to 10)

Earning Money

While your child can start helping with simple household tasks at 2 to 3 years old, it may be a good idea to create a “work for commission” system once they have grasped basic counting concepts. Create a chore chart with age-appropriate jobs for your child to complete every week. At the end of the week, you can reward them with a set amount of money for every task they have completed.

There are a few different philosophies when it comes to paying kids for chores, but your household’s system will ultimately be up to you. Whatever you choose to do, make sure that each of your children is being treated equitably. For example, it’s fair for a younger child to earn a few dollars for simple tasks like feeding the family pet or putting their toys away, but an older child can earn the same amount of money for more complex tasks like folding the laundry and mowing the lawn.

Saving Money

Provide your child with a container for their money, such as a jar or a piggy bank. Transparent containers are ideal, as they allow kids to see their dollars and coins growing in real time. As your child receives monetary gifts and earns money through chores around the house, remind them to store their funds in this safe, designated space.

Don’t feel limited to one container per child. You can add additional savings jars to help them split their money for different things, like long-term savings, short-term spending and giving. You can also help them decorate their containers with pictures or drawings of the specific things they’re saving for, like a new bike, the latest gaming system or their “first car fund.”

Donating Money

It’s never too early to teach empathy, gratitude and generosity. You can help foster these qualities at an early age by teaching your kids about giving back and charity work. Consider picking a cause to support as a family and involve your child in the donation process.

Your kids can make independent choices about donating as well. In addition to their regular savings jar, try introducing a “giving” jar for charitable efforts. Encourage them to set aside $1 for every $10 dollars they receive, let them pick the cause they want to support, and help them as they make the actual donation.

Understanding Needs and Wants

“Can I have this? But I need it! Pleeeeaaase?!” While these demands can be frustrating to deal with at times, they’re great opportunities to teach your child about needs and wants.

Clearly explain what you will pay for (needs), what you won’t pay for (wants), and potential exceptions (like birthday and holiday gifts). Be prepared to have this conversation more than once — younger children will likely need multiple reminders that wanting something badly doesn’t mean they need it!

As your child starts to save and earn, empower them to pick “wants” to pursue. If they really want that brand new toy or that super cool t-shirt, they can turn them into savings goals and pay with their own money.

Avoiding Impulse Purchases

Depending on whether or not your child is a natural saver or spender, they may need extra help to avoid impulse shopping. Encourage them to wait one full day before making any purchase above $15. If they still want it as much as they did after waiting 24 hours, you can bring your child back to the store and let them buy that item with their own money.

You can also teach your kids by modeling positive shopping behaviors. If they hear you considering purchases and waiting a while before committing to buying, they’ll likely do the same.

Advanced Counting and Money Values

Once your child has conquered counting by ones (1, 2, 3, etc.), they’ll next need to master “skip counting” (counting by 5s, 10s and 25s). As your child grows comfortable with counting in groups, you can then start applying this concept to dollars and cents.

Erica Roth at Hello Motherhood suggests starting with pennies and slowly adding other coins over a period of time. Primary Delight also has an excellent article that covers a variety of money counting games and strategies geared towards 1st and 2nd graders.

Middle School (10 to 14)

Future Jobs and Salaries

Most middle schoolers won’t be joining the workforce for a few years, but that doesn’t mean they can’t start to dream about their future career. As your child starts to think harder about what they want to be when they grow up, encourage them to research more. What exactly does a person with that job title do? How much money do those jobs make annually? Does that job require special training or extra years of college?

It’s likely that your child won’t have everything fully decided in junior high, but encouraging them to explore their options now allows them to consider their passions and visualize what their life might be like after high school.

Debt and Borrowing Money

Some kids have trouble understanding that borrowed money must be paid back. When your middle schooler asks for cash, consider allowing them to take out a loan from you. Set an agreement that covers when they need to pay you back by and what consequences they’ll face if they don’t pay by the deadline. If your child doesn’t hold up their end of the agreement, follow through with the consequences and allow them to pay you back through extra housework. While it might seem harsh to them at the time, learning about borrowing through the “Bank of Mom and Dad” will be easier than navigating the consequences of late loan and credit card payments in the future.

Smart and Thoughtful Shopping

Are brand name foods better than generics? Is a clothing item worth investing in if it’s “dry clean only”? Is this in-store promotion a good deal? How can I use coupons to my advantage? Now that your child is old enough to understand the basics of shopping, it’s time to teach them how to spend wisely.

Get your older children involved with household shopping. Ask them to help clip coupons, look for promotions and compare prices. Take the time to talk through purchases and the hidden costs and downfalls of specific items, such as needing to invest in additional maintenance or differences in quality. Teaching your child how to evaluate purchases with you will help prepare them to make informed spending decisions on their own.

High School (14 to 18)

Checking and Savings Accounts

If you haven’t done so already, help your high schooler upgrade from their piggy bank to a checking and savings account at a bank or credit union. Make sure they understand that checking accounts are meant for everyday purchases and withdrawals and savings accounts are meant for bigger purchases in the future.

First Jobs and Taxes

Many teens take on part-time or seasonal work in high school, which means they’ll receive their first official paycheck. Unfortunately, this also means they’ll now be responsible for taxes. Your teen might be asking, “What exactly is tax withholding? Why is my paycheck smaller than I thought it would be? How in the world do I file taxes in the first place?”

You can help prepare your child for those first paycheck deductions by explaining the difference between their gross income and their take-home pay. They’ll also need guidance when they file. Set aside time for you and your teen to fill everything out together, and consider doing it online using IRS Free File.

First Big Purchases

Brand new phones, first cars, new laptops and class rings – whatever your teen is most interested in buying, that first big purchase can be a really big deal! Help them shop around and weigh their options as they make their decision. If they’ll be responsible for additional costs that come with their item, like car insurance or a phone bill, make sure they understand how to pay for it and the consequences of not paying the bill on time.

Even if you’re splitting the cost or making the formal payment while they fund it behind the scenes, the importance of your child’s investment still applies. Celebrate their spending achievement while reminding them to treat that new, big-ticket item with care.

The Costs of Higher Education

Depending on your teenager’s future goals, they may want to go to college or a trade school after earning their diploma. In addition to supporting them as they weigh their options, it’s important to have open and honest conversations about the costs of higher education.

Make sure your teen understands what you’ll help pay for and what they’ll be responsible for. Discuss ways to keep education costs lower, such as taking community college classes, living at home and commuting, applying for scholarships and participating in work-study programs.

If you and your child choose to take out federal or private student loans, make sure they fully understand how their loan works, what fees and interest they may be responsible for, and the consequences of not making their payments.

After High School (18 and Older)

Using Credit Cards Responsibly

It can be difficult to fully grasp the ins and outs of credit cards at any age, especially without proper guidance. Some parents may choose to add their teen as an authorized user under their credit card, but your child typically won’t be able to obtain a credit card under their own name until they’re at least 18.

Before you let your teen run free with their first credit card, make sure they understand that credit is not “free money.” They should know their credit limit, when they’ll be responsible for paying the money back, how to pay, and the consequences of not paying their bill on time. This is especially important if you’re a cosigner — if your child racks up debt on your shared card, you’ll be the one who’s responsible for it!

Check out Money Under 30’s Credit Card Basics page for an overview of what older teens should know about credit cards.

How to Build Credit

A good credit score can give your child more bargaining power and better access to high limits and low interest rates. It can also make the approval process easier when they apply to rent. But what happens if you don’t have any credit history?

There are a few easy steps you and your child can take to start establishing a credit history, including getting a student or store credit card, becoming an authorized user on someone else’s credit card and making on-time bill payments. Check out our 10 part guide for more information on building a credit score from scratch.

Paying Rent, Utilities and Bills

Water and electricity and internet — oh my! As your child prepares to leave your nest and live on their own, you may agree to help them with some of their living expenses for a period of time. However, you’ll need to communicate with them about when you plan on shifting those responsibilities onto their shoulders.

Whether you go “cold turkey” and hand over all of their bills at once or ease them into taking on one payment at a time, encourage your child to keep careful track of when each payment is due. They’ll also need to make sure they have enough money in their account before payments are pulled. Encourage them to create and follow a budget so they can avoid overdraft mishaps. If they decide to enroll in auto pay, remind your child to check in regularly to make sure the correct amount of money is being pulled and that enough funds are available for each pull.

In Summary: Learning About Money Is a Lifelong Process

Your child won’t become financially literate overnight, and some money milestones may be more difficult for them to grasp than others. That’s perfectly okay! Just like any school subject or life skill, mastering money takes time, practice, patience and real-life experience. By starting financial conversations early and addressing money with your children often, you can help them grow up to become money-savvy adults.