The first full decade of adulthood is an exciting time. With their teen years in the rearview mirror, 20-somethings get to experience a new sense of freedom and independence as they tackle the real world on their own. This time also comes with many overwhelming firsts, like entry-level jobs, big-ticket purchases, new living expenses, investments and debts.

Looking to stay on top of your finances while still enjoying your twenties to the fullest? Here are 10 financial objectives to focus on between the ages of 20 and 29:

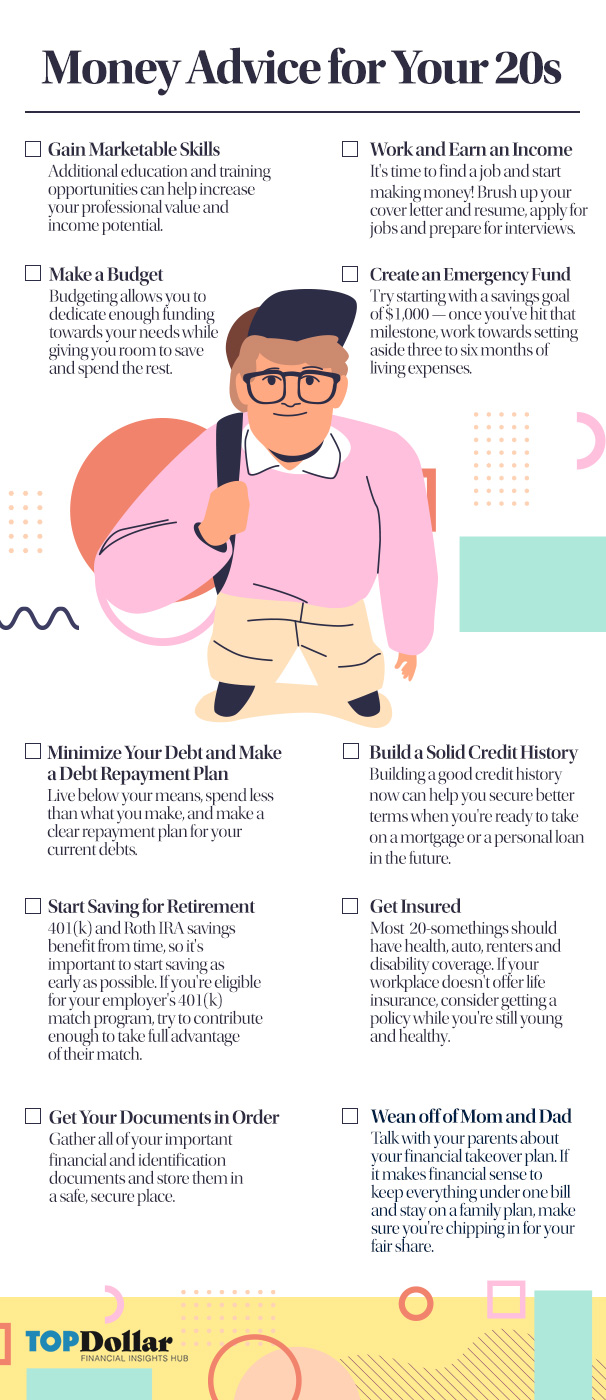

Gain Marketable Skills

As you transition out of your teens and into your twenties, you’ll need to have the proper training and skills to excel in the workforce and start earning. While the default assumption is that you’ll need a college education right after high school, you have options. You may choose to obtain a diploma or certificate at a trade school, take relevant courses through a Massive Open Online Courses (MOOC) provider, receive specific training in the military or learn on-the-job through a work training program. You can also put college on pause and save up for classes in order to avoid hefty college loans later.

Additional education and training opportunities can help increase your professional value and income potential — don’t forget to list what you’ve earned and completed on your resume!

Work and Earn an Income

Once you’ve gained the knowledge and skills needed for your trade, it’s time to find a job and start making money. It’s rare that a job will magically fall into your lap — you’ll likely need to brush up your cover letter and resume, apply for jobs and prepare for interviews.

Be open to the work opportunities that come your way, even if they seem “beneath” you. Entry-level jobs often come with menial tasks and low pay, but they can provide you with the “foot in the door” that you need to gain experience and work your way up in your industry. Hard work and a can-do attitude during your first working years can go a long way in helping you earn raises, get promotions or qualify for more senior-level positions elsewhere.

Make a Budget

Now that you’re earning money, it’s time to make a smart plan for what to do with it. Budgeting allows you to dedicate enough funding towards your needs while giving you room to save and spend with the rest. Without a budget, you risk overspending and not being able to cover the necessities.

“You should always know where your money is going because otherwise, it is all too easy to lose track of it,” noted Donna Tang, budgeting expert at CreditDonkey. “When you see where all of your money is going and how much of it is going to which things, you will be a lot less likely to spend money frivolously.”

New to budgets? Check out this free budgeting worksheet and our piece on 50/30/20 budgeting to get started.

Create an Emergency Fund

Most 20-somethings feel financially vulnerable. After all, if you’re just starting to earn an income and juggling new expenses, a surprise medical bill or car repair can suddenly put you in the red. Prepare for the unexpected in advance by putting money aside for your emergency fund.

Many experts recommend setting aside three to six months of your living expenses for your emergency fund, but this can be a tough savings goal to reach when you’re just starting out on your own. Try starting with a savings goal of $1,000 — once you’ve hit that milestone, you can continue to work towards a larger cushion of savings.

Minimize Your Debt and Make a Debt Repayment Plan

Many young adults incur debt in their twenties. Between student loans, new credit cards and the costs that come with living on your own for the first time, you may find your debts growing into a mountain in a very short time period.

The best way to stay on top of your current debt is to make a clear repayment plan. Use tools like credit card and student loan payoff calculators to help you determine how long it will take to pay off your debt. Consider utilizing a debt repayment strategy to tackle your payments as quickly as possible, such as the snowball or avalanche method. If you’re still struggling to see a clear way to pay back what you owe, you may also benefit from debt help.

As for avoiding future debt? The key is to live below your means and spend less than what you make. If you find that you’re living paycheck-to-paycheck, look for ways to trim down your monthly spending so you can divert those leftover funds towards your emergency fund and your future financial goals.

Build a Solid Credit History

You may not be ready to take on a mortgage or a personal loan in your twenties, but building a good credit history now can help you secure better terms when you’re ready.

“Lenders like to see a strong history of borrowing and repaying debt before they approve a loan, and people with no credit history may be forced to accept a higher interest rate, larger down payment, or be ineligible to access credit.” explained Timothy Iseler, founder of Iseler Financial.

Need more help building your score? Check out our 10 part guide to building credit with no credit history.

Start Saving for Retirement

Retirement seems so far away when you’re just starting your career, but it’s important to start preparing as early as possible. 401(k) and Roth IRA savings benefit from time, even if you’re only able to make small deposits at the start.

“Thanks to compound interest, the earlier you start investing, the more time your money will have to grow in value,” said Anna Barker, founder of Logical Dollar. “This means that, over the course of your life, you’ll actually have to invest less of your own money in order to reach an amount you need to retire.”

Many employers offer to match some or all of their employee’s 401(k) contributions up to a set limit. If you’re eligible for your employer’s 401(k) match program, try to contribute enough to take full advantage of their match — it’s essentially free money!

For example, let’s say that your work offers a dollar for dollar match on the first 5% and you make $35,000 a year. If you commit to contributing $1,750 of your salary each year to your 401(k), your employer match will mean that your 401(k) is actually getting $3,500 a year.

Get Insured

Accidents and emergencies can take a major toll on your finances if you aren’t adequately insured. As you start to make your way on your own and become more independent, you’ll need to determine what kinds of insurance you’ll need. In certain cases, such as renting a home or driving a car in some states, insurance is mandatory.

If you’re covered under a parent’s insurance plan, you may choose to stay on their health insurance until you turn 26. Aside from health coverage, Business Insider recommends that 20-somethings also obtain auto, renters and disability insurance.

If your workplace doesn’t offer life insurance, it may be a good idea to purchase a policy while you’re still young and healthy. “By doing so, you have the ability to lock in extremely cheap prices for life insurance,” explained Matt Schmidt, CEO of Diabetes Life Solutions. “Those who put off purchasing a policy run the risk of developing a health condition that may cause premiums to be higher.”

Get Your Documents in Order

When you leave your parent’s nest, both physically and financially, don’t forget to pack the paperwork. Make sure you bring any important documents and identification with you and store them in a safe, secure place. Important items in your possession may include:

- Birth certificate

- Social security or ITIN card

- Passport

- Forms of identification

- Professional licenses

- Savings bonds

- Car registration and title

- School transcripts

- Vaccination and medical records

- Tax documents

Wean off of Mom and Dad

Becoming financially independent from your parents may seem like a scary transition at first, but it’s an important step out of your childhood and into adulthood. This transfer of responsibility is different for every family: some parents choose to cut their children off cold-turkey on a specific date, while others slowly stop covering expenses over a period of time. Whatever your family’s plan is, it’s best to be prepared ahead of time.

Talk with your parents about your financial takeover plan. Outline all of your expenses and create a timeline for when you’ll take the reigns. If there are some costs that your parents want to continue to pay for, such as a portion of your student loans or your health insurance until you turn 26, make sure you’re clear on how much they’re covering or how long they plan on covering it for.

In some cases, such as a cell phone family plan or shared subscription, it makes sense to keep everything under one bill and let your parents make the payment. That doesn’t mean you should skip out on payments — exercise those independence muscles by chipping in for your fair share.

Money Advice Beyond Your 20s

Healthy finances don’t begin and end in your 20s. Check out more decade-specific tips below: