Decorating your home, buying gifts and making elaborate holiday meals are just a few of the things that make the holiday season so special year after year. Holiday fun is a great escape from the doldrums of everyday life, but all that fun and diversion can get pricey. Instead of spending on the holidays and worrying about the debt later, we recommend following some planning guidelines. Your holiday season doesn’t have to be totally debt-free, but these tips will help you spend what you can afford to pay back.

If you recently tightened your budget and have less wiggle room for spending, you might be tempted to fund your seasonal activities with credit. It’s essential to be cautious about using credit cards to pay for non-essential spending. Otherwise, you might wake on January 1st with a credit card hangover that gets the new year off to a bad start.

Quick Links

Set a Spending Cap

Take Stock of Current Debt

Using Credit? Set a “Pay By” Date

Avoid In-Store Credit Card Offers

Reduce Spending with Thrifty Holiday Tips

Set a Spending Cap

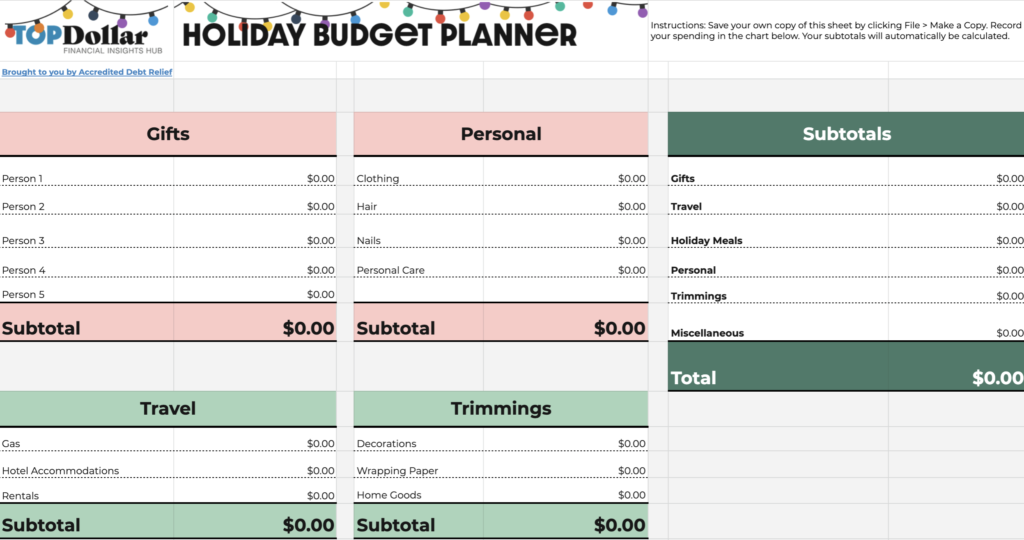

Figuring out how much you can afford to spend this holiday season means taking a fresh look at your budget. Begin by creating a holiday budget that helps you estimate what you plan to spend and calculate what you can afford to pay for in cash and what, if anything, you’d like to pay for using credit.

We like using the 50/20/30 Budget Rule, which says; 50% of your monthly income should go toward financial obligations like housing, food and other bills. 20% of what you make should be put in savings, and the remaining 30% can be used for everything else. You can use this rule both at the annual budgeting level and also at the monthly level.

Your holiday spending should fit nicely into your budget and be covered by that 30%. Of course, it won’t account for the entire 30%, but you can make tweaks to your spending to set aside as much as possible for your discretionary spending.

If your monthly obligations are more than 50% of your total spending, then reformatting your budget is going to be a top priority. Consider taking steps to downsize before you commit to seasonal expenditures.

Take Stock of Your Current Debt

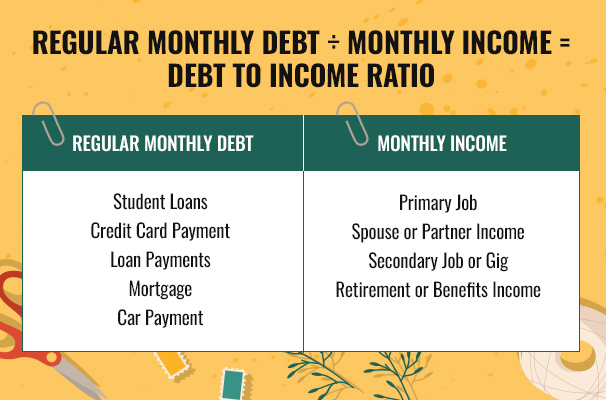

Do you already have a lot of debt? Taking stock of your current debt and calculating your debt to income ratio (DTI) is a great way to assess your credit health. Calculate your DTI ratio by adding up all of your regular monthly debt payments and dividing it by the amount of money you make every month.

If your DTI is under 20%, using credit may be less risky for you. If it is higher, charging your holiday spending on a credit card may not be a good idea.

Ultimately, you want to make sure that whatever you charge to a credit card can be paid back in a timely fashion. Having a sizeable revolving balance will cost you money in the long run and could upset the balance of your monthly budget until you resolve the debt.

Using Credit? Set a “Pay By” Date

You might decide to use credit to cover holiday expense for a few reasons:

- Take advantage of credit card rewards

- Cover expenses when you don’t have enough cash on hand

Whatever the case may be, you should set a “pay by” date and decide on a monthly payment amount so that you can pay back the debt. A “pay by” debt is a self-imposed plan so that you don’t end up paying more in interest than you have to. Avoid making the minimum payment and instead, pay as much as you can each month to resolve the debt quickly.

For example, let’s say you charge $800 to a credit card with an 18% interest rate and a 3% minimum payment. For that balance, the minimum payment on the card will be $24. You decide that you want to pay down the balance in full in 4 months. So, you choose to pay $200 each month.

If you were only to pay the minimum payment, it would take you 78 months (8.5 years) to pay off the balance and would cost you $498.37 in interest, more than the amount you borrowed.

By making $200 payments, you’ll be free of the debt in 5 months and should end up paying around $31 in interest.

Avoid In-Store Credit Card Offers

These days almost all stores have some sort of credit card option, and they love to tempt us at the register with sign-up bonuses. Generally, if spending too much is your concern, you should avoid getting a store credit card for a one-time discount. The savings usually do not outweigh the hassle of managing a new card balance or the temptation to use new credit.

We don’t recommend treating a credit card sign-up like a one-time coupon. Most credit card sign-up offers require you to make a purchase on the card right away. Remembering to pay off all the balances before you are charged interest can be a lot of work. Also, getting too many store credit cards can lower your credit score because opening more than a few lines at a time reduces the average age of your accounts and is viewed by potential lenders as risky behavior.

Pick up a Side-Hustle to Fund Your Holiday Spending

Once you have a clear budget for your holiday spending, you’ll know how much money you need to have on hand to afford your holiday plans. Having an amount of money in mind is especially helpful if you are able to pick up extra work to foot the bill.

Side hustles are becoming more and more popular to pay for extras not covered by your regular income. Side hustles are essentially part-time jobs and are usually flexible to accommodate your full-time position. Many of these gigs are app-driven in our digital age and allow you to set your own hours.

For example, car services like Uber and Lyft are very popular during the holidays. Additionally, apps like Wag! Offer on-demand dog walking. If app-based work isn’t your thing, you can pick up a part-time job at a local store, sell handmade goods on websites like Etsy or offer a special service like mending or handiwork.

Check out this list of 40 side hustles to try in 2020.

Reduce Spending With Thrifty Holiday Tips

As you plan your holiday festivities, one great way to avoid debt down the road is to be proactive about spending less money. There are many resources online with tips and ideas for thrifty holiday decorations, gifts, activities and more. Deciding what to buy and what to DIY means prioritizing your holiday budget. If you have your heart set on some expensive gifts, consider going the DIY or Thrifted route for holiday decor.

If you are already saving on decorations by reusing one’s from years past, you can save even more money by making thoughtful holiday gifts instead of buying things at the store.

Check out this list of ideas, and don’t forget to make a holiday budget!

By doing a little research, you can still have a fun and vibrant celebration that won’t break the bank or leave you with lots of debt in the new year.