Updated April 13, 2023

Creating and managing a budget is a great way to help you stay on top of your finances. You can ensure that you have enough to cover your expenses while also determining what to cut back on by planning out your spending every month. Fortunately, a recent poll reported that 69% of respondents keep a family budget, which means almost 7 out of 10 of us are on the right track.

Whether you’ve never created a budget, fell behind with keeping track of your money, or simply want to update your current plan, we’ve created a free budgeting worksheet that you can use to map out your finances.

Budget Planner Basics

Your first step to planning your budget is to gather your monthly bills and pay stubs – what money are you bringing in, and what money is going out? Make note of every expense and source of income that you have.

It may help to review your bank and credit card statements from the past few months; this might reveal any subscriptions or monthly charges that you may have forgotten about, and it can help you estimate your average monthly spend on categories that aren’t always consistent (like groceries and utilities).

Record All Income and Expenses

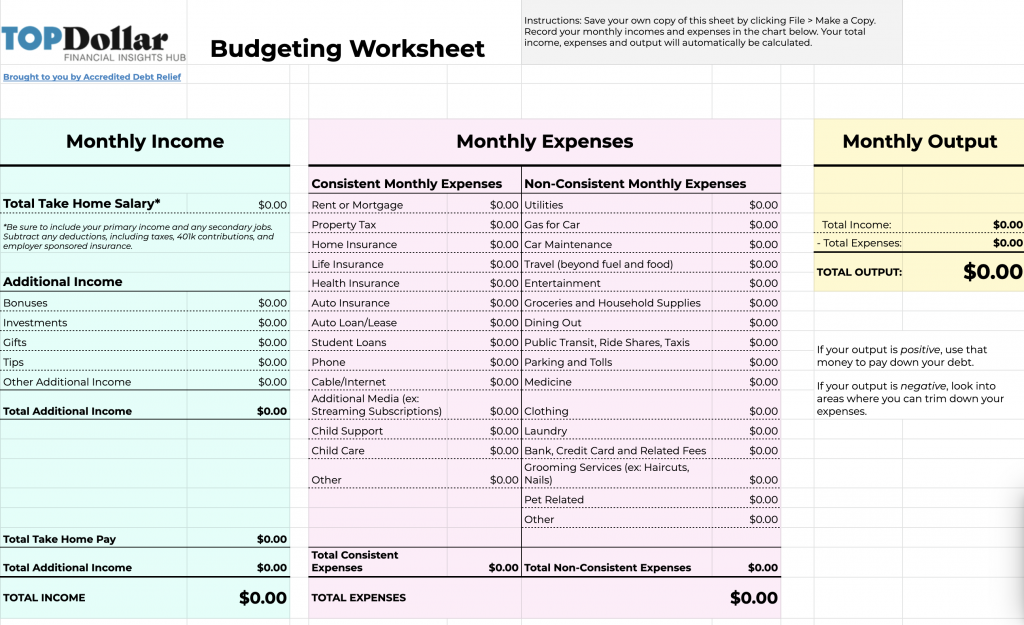

You should record all of your income and expenses in a trackable format, preferably sorting your money by category. We’ve created a budgeting sheet that you can save and customize here. You may also choose to use a budgeting app or track everything with paper and pencil. Use whatever system works best for you!

Once you’ve tracked your monthly earnings and spending, combine your total expenses and subtract them from your total income:

Income – Expenses = Total Output

If your output is a negative number, it’s time to find ways to cut down on your spending. Can you trim down how much you’re spending on eating out, avoid shopping for clothes for a month, or cancel your streaming service to save money?

If your total output is a positive number, congratulations! You have extra money that can be used to build your savings or put towards paying down debt. Keep tracking your monthly spending and continue to look for ways to save more.

Budgeting Tips

Remember that your budget is not set in stone. You can change your budget to fit your life situation at any time. Keep it up to date by adjusting your categories and your allotments as needed.

Tracking your money and sticking to a budget also takes practice. If you miscalculate while you track or overspend in one category along the way, don’t get discouraged! Use your budget as a tool to improve your spending habits and take back control of your finances.

Top Dollar’s Free Budgeting Worksheet

We’ve created a free budgeting worksheet for our readers – check it out here!

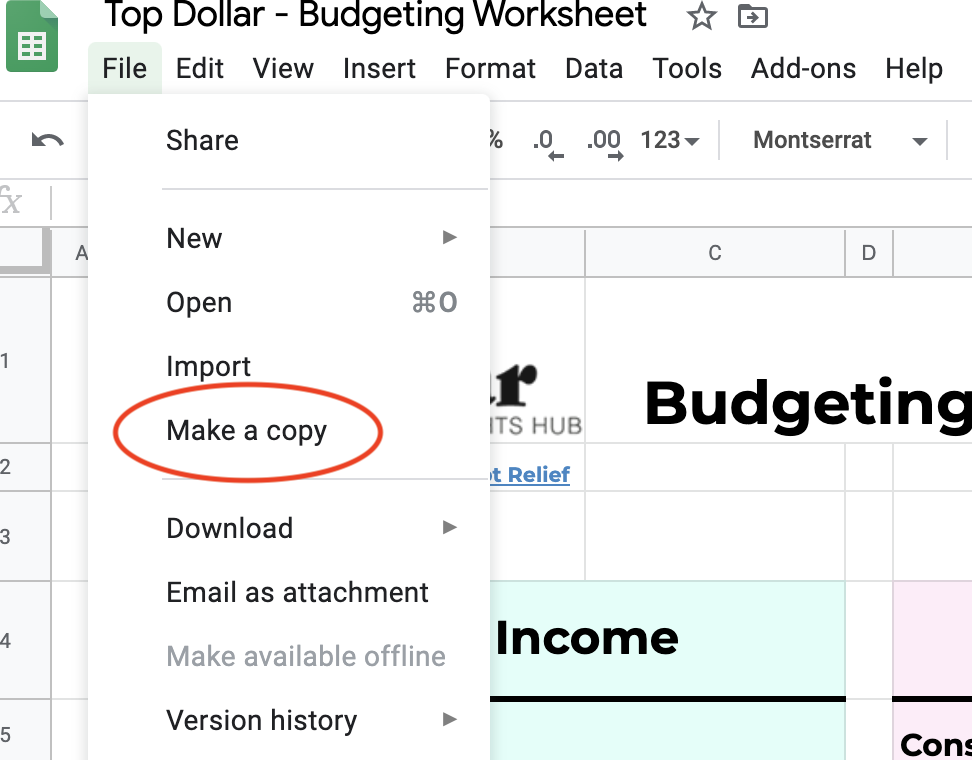

Our copy is locked for editing, but you can save your own version to edit as you please. Simply click “File” and “Make a copy” in the upper left-hand corner to save.

Find the Right Budget Strategy for You

There are several different strategies and tools you can try as you build your budget. Whatever approach you choose, remember that the key is to stick to it consistently and make adjustments as needed to ensure your financial success.