Budgets are a fantastic tool. They can shed light on your financial health and habits and are often considered a non-negotiable first step in financial planning and wellness. Yet, for some, traditionally, budgeting is a frustrating chore that requires a lot of effort without leading to lasting change. If you’ve given budgeting an honest try and still feel it doesn’t work well for you, then an anti-budget could be the solution worth exploring.

Why Traditional Budgeting Might Not Work for You

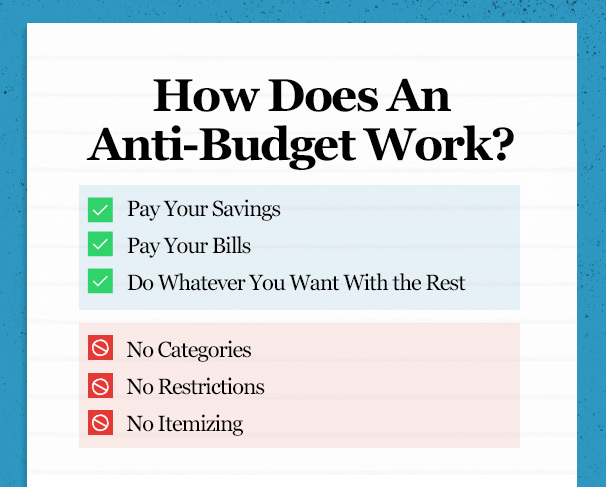

Traditional Budgets are incredibly detailed and usually focus heavily on spending. They require you to categorize everything and often result in spending restrictions intended to help you free up funds for savings and investments. While a detailed budget can help you get a handle on where your money goes, they usually require restrictive, inflexible, and time-consuming maintenance to be successful.

Traditional budgets can be:

- Detailed

- Time Consuming

- Restrictive

- Aspirational rather than realistic

- A bad fit for certain personality types

It’s easy to create an overly ambitious plan that is not realistic for your lifestyle. When you fail because a budget was too aspirational, it can be easy to give up and lose confidence in your ability to make changes to your financial well-being.

Budgeting may be a bad fit if you have a personality type easily overwhelmed by details and strict adherence to a routine. If any of this sounds familiar, an anti-budget approach might be better suited for you.

What Is an Anti-Budget?

The anti-budget was created by personal finance blogger Paula Pant of Afford Anything. The idea behind the anti-budget is that you pay your savings, pay your bills, and use whatever is left any way you want. That’s it. No more categories or spending limits, just a straightforward approach that is extremely easy to automate!

5 Steps To a Perfect Anti-Budget

- Calculate your monthly income

- Calculate your monthly bills

- Decide on an amount to put into savings every month

- Automate everything

- Spend the rest as you see fit

Calculate Your Monthly Income

This step is fairly simple if you make a regular monthly salary. We recommend calculating what you make post-tax so that you know exactly how much money will be added to your bank account each month.

Calculate Your Monthly Bills

This step is a little more complicated, but you only have to do it once or whenever your monthly spending changes in a big way (i.e., moving and updating your rent.) Take a look at your spending from the previous month and add up every bill or recurring payment made.

Don’t include variable daily expenses like groceries or gas. Do include monthly recurring bills like credit card payments, utilities, rent, subscriptions, medications, etc.

Decide How Much To Pay Yourself in Savings

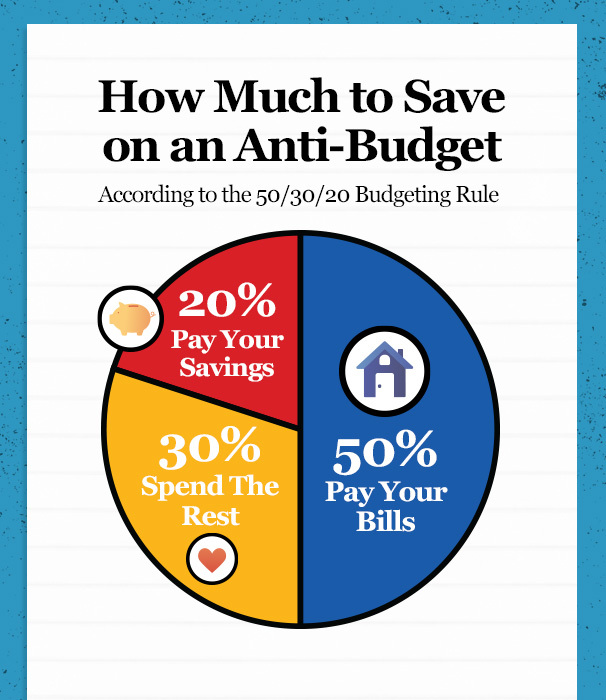

Experts typically recommend saving 20% of your monthly income, based on a popular budgeting technique called 50/30/20. In this method, 50% of your income goes toward things you have to have no matter what (like bills, utilities, and food), 30% is for wants and the remaining 20% goes into savings.

Automate Everything

Set it and forget it is by far the best savings technique around. Technology makes it possible for us to transfer money and pay bills automatically, so we don’t have to worry about it.

If your employer directly deposits your paycheck into your bank account, arrange for your savings to go straight into your savings account.

- Bill payment

- Direct deposit

- Automatic transfers from spending accounts to savings accounts

Customize Your Anti-Budget

If you have multiple savings goals in mind, you can customize yours. Consider that you may decide to split monthly savings among multiple accounts like a regular savings account, emergency fund, retirement savings, a vacation fund, etc. While this adds a layer of complexity to the process, all the deposit amounts can be determined upfront. Ideally, you would automate the deposits, so you don’t have to think about them.

Making changes to how much you spend on bills or editing your monthly savings deposit could be necessary from time to time to accommodate your needs.

Changes to your bills

- For example, paying down a credit card balance in a lump sum

Changes to your monthly savings

- For example, pausing or editing a monthly savings deposit to pay for a car repair or other emergency expense

Cut Back on Spending

Although this method doesn’t impose any restrictions on where and how you spend your money, you may decide to cut back on spending in specific ways.

When you calculate how much you spend on bills, take a look at non-essential recurring expenses like subscriptions. Are these still important to you? Do they align with your current news and values? You might be able to save a few hundred extra dollars a month simply by removing non-essentials that you won’t miss.

Why Do Anti-Budgets Work?

Anti-budgets tend to work because they are easy to follow and focus on the big picture. For most people, the purpose of a budget is to build your savings. Traditional budgets focus on how you can cut spending to satisfy your savings goal.

An anti-budget simply invites you to put the saving step first and then spend whatever you have left on whatever you want.

For example, you’ll never need to track how much you spend on groceries or feel guilty about splurging on something you enjoy, as long as the funds you have in your spending account are enough to cover the cost.

It’s possible to overspend on an anti-budget, so to avoid running out of money halfway through the month, it’s a good idea to check your bank balance every so often to make sure you aren’t overdoing it with impulse buys. Many bank accounts allow you to set up automatic balance alerts, which can help you think ahead and make smart decisions.